Barclays

-

UniCredit attracted plenty of demand for a €1.25bn sale of non-preferred senior debt in euros on Wednesday, as issuers took advantage of strong funding conditions ahead of the summer period.

-

The Inter-American Investment Corporation (IDB Invest) raised $1bn with a three year bond on Tuesday, while the Japan International Cooperation Agency tested the water with a 10 year dollar transaction, opening up an opportunity for the Province of Alberta to follow suit.

-

Two groups of UK MPs held an online meeting today to welcome and promote a report into how the banking sector can support a ‘just transition’ to a low carbon economy. The report’s recommendations included creating a National Investment Bank to replace the role played by the European Investment Bank and for the UK to issue a green Gilt.

-

The Swedish National Debt Office has selected the maturity range for its debut green bond and the banks that will lead the transaction, which will take place via syndication in August.

-

Fitch played down fears about the impact of payment holidays on UK covered bond pools this week, arguing that high credit quality would offer a strong line of defence against defaults.

-

Investors have been given their first taste of how regulatory relief could bolster bank capital levels amid Covid-19, after Barclays told the market this week to expect a drastic improvement in its common equity tier one (CET1) ratio in the second quarter.

-

Indian solar power company SB Energy pulled its planned dollar bond late on Monday after grappling with a soft market backdrop and investor demand for a juicy premium.

-

Following investor calls last Friday, two public sector borrowers hit the market for new dollar bonds on Monday, with IDB Invest going for a three year maturity and the Japan International Cooperation Agency making a rare appearance for a 10 year trade.

-

Dalata, the Irish hotel group, has amended its main revolving bank facility to increase the size to €364m and take a break from covenant reporting. Loans bankers say the hospitality industry will still need more concessions from lenders, despite starting to reopen across Europe.

-

US corporate bond issuers got straight back to business after the July 4 weekend as 11 borrowers raised $10.8bn, though the volume of issuance is tapering off as companies head into earnings blackouts.

-

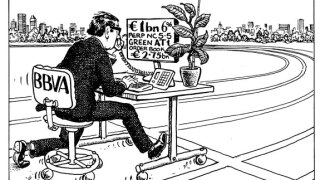

BBVA has become the first bank to print a green additional tier one (AT1) deal. When it was issued this week, it proved that the demand for socially responsible investments (SRI) extends to the riskiest of asset classes, meaning other banks are certain to bring out their own versions of the trade, writes David Freitas.

-