Banks

-

Senior figures change jobs as new banker takes charge

-

◆ Deal draws accolades ◆ Result suggests others may issue before Thursday's central bank meetings ◆ Proceeds for EV financing

-

Development bank now 82% funded for the year

-

◆ Transaction 'looks attractive' say analysts ◆ Issuer 'bondholder-friendly' ◆ US market 'remains open'

-

Agency attracts big book and raises $1bn with inaugural print

-

◆ Regular Australian dollar presence planned ◆ Asian, Aussie and Kiwi investors dominate ◆ Premium paid over euro funding

-

The US challenger has embarked on another aggressive round of hiring from rivals. Armed with a balance sheet, it wants to break into Europe’s top five

-

Action comes on top of bond misreporting scandal and investigation of alleged malpractice

-

◆ The A$750m deal, bankers say, shows rise in European Kangaroos ◆ Deal clears despite heightened volatility elsewhere ◆ Oversubscription concentrated in one tranche

-

German state launches oversubscribed €500m deal close to secondary curve

-

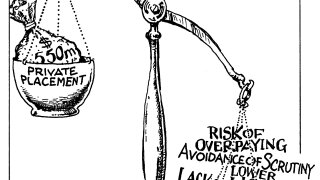

Investors dislike the lower transparency and liquidity inherent in private placements

-

IADB taps sterling while two other issuers mandate for new issues