Banks

-

Sovereign achieves diversification goal with first syndicated green bond

-

CEO Jane Fraser stunned investment bankers in Europe with a fundamental overhaul of its corporate and investment banking business

-

Second benchmark in the currency for the Finnish issuer takes funding to 85%

-

◆ ALD expands after buying LeasePlan ◆ New deal dwarfs previous issues from either company ◆ Investors show support with €2.8bn of orders

-

◆ Deteriorating market conditions made worse by investors demanding higher premium ◆ 'Wise' decision to print after two days of calls ◆ Shawbrook sells private placement-like tier two in sterling

-

Land hits upper end of size target after being 'reasonable' about pricing

-

◆ SocGen is still majority owner but no longer has full ownership ◆ Deal will be two and five year senior preferred

-

◆ Pent-up demand supports issuer set to regain IG ◆ Concession was 0bp-10bp, below what eurozone periphery smaller issuers have paid ◆ BayernLB chooses extra day of marketing for tier two

-

Dkr7.75bn deal is Denmark's second green bond after an auction last year

-

◆ ING raises €1.75bn from first opco issue for four years ◆ Rare deals meet good investor response ◆ Bid is much stronger for shorter tenors

-

KfW's long seven year in SSA market could indicate whether covered deals too could extend beyond five years

-

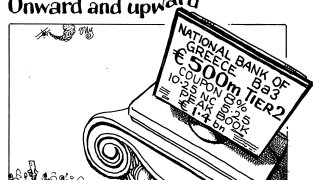

◆ Both deals are expected to price as early as Tuesday ◆ Unlikely to compete for demand due to differing ratings and buyer bases ◆ NBG will print the first Greek bond after Moody’s rating upgrades