Banks

-

-

Swiss pharma company navigates a difficult market to pay a negative to zero new issue premium

-

Supra to issue five year paper and tap its green February 2048s

-

US dollar market helped the province to raise an equivalent of five to six domestic bonds

-

◆ The 'powerful technicals' driving success in unsecured issuance ◆ Nykredit takes advantage with 'solid' deal ◆ German issuer the only other benchmark deal being marketed

-

Next year's target for the Austrian agency will be around €6bn

-

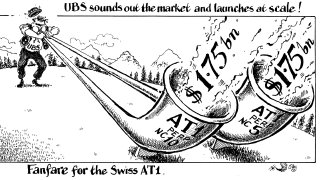

Investors pounce on Société Générale and UBS sales after yields rise, then rates rally to soothe fears

-

◆ First AT1 for nearly two months after volatility ◆ Priced flat to or inside fair value ◆ Head of funding says deal could have been bigger

-

◆ SocGen and especially UBS garner huge demand for high yielding AT1s ◆ Red-hot interest suggests more European banks could issue in subordinated Yankees ◆ HSBC and BBVA raise $2.75bn in tier two

-

A swift combination of the UK investment banking teams of UBS and Credit Suisse shows the rapid progress that has been made, as CEO Sergio Ermotti looks ahead to a ‘pivotal 2024’

-

Kiwi sub-sovereign sacrifices size to price tight

-

◆ Deal is French insurer's first bond since 2014 ◆ Strong demand for higher yielding assets results in pricing close to fair value ◆ Book reaches around €3bn