Top Section/Ad

Top Section/Ad

Most recent

Investors saw plenty of juice in first public AT1 from Chile as regulatory framework draws praise

Mexican lender falls short of bond size target as late 2023 momentum fades

◆ US RMBS sales in Europe: immigration or vacation? ◆ UBS AT1 makes nonsense of claims of investor fears ◆ The EU's last hurrah in the SSA market

◆ IG investors comfort eat sweet spreads ◆ What can FIG issuers do now? ◆ US HEI securitizations: mainstream or flash in pan?

More articles/Ad

More articles/Ad

More articles

-

Allianz said it would call one of its upper tier two bonds this February, pleasing market participants who thought the German insurer might extend the life of the instrument.

-

There is plenty of room for innovation among insurers in the capital markets in 2017 as new products show their first signs of life. But bringing these new tools to market will be a stern challenge, writes Tyler Davies.

-

Additional tier one (AT1) went through the most turbulent period of its young life in 2016, and the experience was nothing if not formative. This year banks will benefit from the market’s new-found maturity. Tyler Davies reports.

-

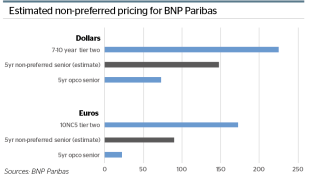

Tier three will become the new face of senior debt in 2017. The stage is finally set for the largest French banks to make their push into the new asset class, but issuers all over Europe will be looking to optimise their senior stacks for regulatory capital standards. Tyler Davies reports.

-

A private sector recapitalisation of the ailing Italian bank, Monte dei Paschi di Siena, is looking increasingly unlikely, following the limited take-up for the liability management exercise and low interest in the equity raising, meaning that state-led intervention will now be needed.

-

European financial institutions need up to €500bn of new loss-absorbing debt to meet their minimum requirement for own funds and eligible liabilities (MREL), according to analysts at BNP Paribas.