Awards

-

Citigroup Citigroup has been lauded by buysiders for its synthetic collateralized debt obligation business, particularly for its work around index and bespoke tranches. The global credit markets group, headed by Carey Lathrop, has been investing heavily in its electronic trading capabilities and has been seen as a leader in index and bespoke synthetic tranches, particularly at a time when others have been focusing on restructuring or unwinding existing large CDO trades. Notable deals include an equity tranche of a EUR 1.2 billion portfolio, where the firm was hired by a competitor based on its wide reaching distribution channels, and over USD 11 billion of traded equity index tranches (through April of this year).

-

China’s currency and capital account restrictions have long hampered overseas investor attempts to buy into its spectacular growth story. So the birth of an offshore market providing corporates and institutional investors with exposure to renminbi-denominated assets has generated a great deal of excitement.

-

-

-

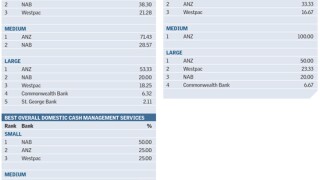

ASIAMONEY reveals the best foreign cash management providers in each country in the region, according to our corporate respondents.

-

ASIAMONEY reveals the best local cash management providers in each country in the region, according to our corporate respondents.

-

The US bank stood out in almost all rankings of our latest survey of Asia's providers of top FX services. Its rise forced HSBC, which was last year's most impressive bank according to financial institutions, into third place in that category. Meanwhile it remained the best service provider for corporates.

-

The region’s fixed income markets are growing on the back of rising investor demand, increasing debt volumes, and the desire to be protected from – or take advantage of – market volatility. ASIAMONEY’s first Fixed Income Poll reveals which banks in particular stand tall in this growing market.

-

US bank Citi continues to impress the most regional companies for its cash management services, while BNY Mellon emerges as the best firm according to medium and large financial institutions.