Awards

-

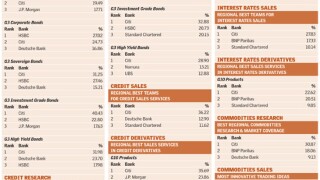

The extended results for China, Taiwan and Hong Kong in Asiamoney's inaugural Fixed Income poll featuring Citi, HSBC, ANZ, BNP Paribas and others.

-

The overall regional and domestic results for Asiamoney's inaugural fixed income poll featuring Citi, HSBC, Deutsche Bank, Standard Chartered and BNP Paribas and others.

-

The extended results for India, Indonesia, Korea, Malaysia, Singapore Thailand and the Philippines in Asiamoney's inaugural Fixed Income poll.

-

The US bank stood out from the competition when it comes to credit, interest rates and commodities, according to voters in our inaugural Fixed Income Poll. HSBC, Deutsche Bank, and BNP Paribas were also well-regarded.

-

Mark Yallop, Group COO of ICAP, has worked in the swaps and derivatives industry for nearly 30 years. He is referred to by his peers as an expert in business management with an ability to identify growth opportunities. His role in elevating ICAP into one of the leading interdealer brokers focused on electronic trading and post trade services and, prior to that, successfully setting up Deutsche Bank’s global trading and sales business, make Yallop a standout individual in the industry and a worthy recipient of the Outstanding Contribution Award. It is from his time at Deutsche Bank, particularly between 1995 and 2000, that Yallop identifies his greatest achievement, as he was part of the team that built Deutsche’s trading and sales capabilities. “The thing that I feel proudest about is taking something that was a concept, and which most observers thought was a pipedream—namely building a leading trading and sales franchise from scratch—and helping to make it a reality: a firm that didn’t even register on the global investment banking map in the early nineties to being a top three firm by market share, revenues and reputation just five years later,” he said.

-

CQS CQS, the USD11 billion hedge fund manager founded in 1999 by Goldman Sachs’ former head of equity trading Michael Hintze, has been impressing dealers with its expertise in convertible bonds and asset backed securities as well as the consistency in its positive performance. Officials in the credit derivatives market have also heaped praise on CQS’ credit long/short fund, launched in 2009, noting that the fund had been at the forefront of the market in credit default swaps and bonds since inception.

-

Allen & Overy Allen & Overy continued to burnish its reputation as a leading regulatory and industry derivatives advisor over the last year, particularly with its work with the International Swaps and Derivatives Association’s working groups and determinations committees as the industry gears towards standardizing contracts. Investors cited the firm’s ability to provide advice for both vanilla and exotic derivative structures globally. Examples cited included its work in advising on new structured UCITS compliant funds and fund umbrellas, as well as advising a host of central counterparties on their applications as derivative clearing organizations. Partners cited include David Benton and Ed Murray in London, and David Lucking and Deborah North in New York.

-

BGC Partners BGC Partners has been expanding its electronic trading business in 2011. In May it executed its first fully electronic euro sterling interest rate option on its Volume Match tool on BGC Trader, three months after it executed its first fully electronic Australian dollar interest rate swap and electronic sterling interest rate swap on BGC Trader. Analysts point to the growth of the firm’s electronic interest rate derivatives trading business, which in the first quarter of 2011 drove a 24.9% year-on-year increase in fully electronic trading revenues, as evidence to the expansion the firm has made in staff and technology over the last year. Those personnel seen as driving the expansion include Howard Lutnick, chairman and ceo, Shaun D. Lynn, president, and Philip Norton, global head of e-commerce.

-

Bank of America Merrill Lynch The firm has landed investor plaudits for its emerging market structured product coverage and inventiveness in cross-asset solutions. They cited the firm’s presence and marketing of cross-asset products in Asia, such as the launch of its USD8 billion retail structured note program in Singapore. Over the last year the firm has been expanding teams in Europe, the U.S. and Asia, with notable hires including Anupam Gupta as head of Central and Eastern Europe, Middle East and Africa structuring, and Paul Hansen as head of Canadian structured solutions. Senior officials include Yonathan Epelbaum, head of U.S. structuring, and Alexis Besse, head of rates and currencies structuring.

-

Bank of America Merrill Lynch Bank of America Merrill Lynch stood out among its peers for its strength in making markets. The firm has been pushing its interest rates derivatives business globally, with Craig Reynolds as head of North American rates trading and Chris Hodson leading rates trading for Europe, the Middle East and Africa. The firm has been at the front of the over-the counter derivatives clearing charge, last year launching its global futures and derivatives clearing services group.

-

Bank of America Merrill Lynch Investors named Bank of America Merrill Lynch as a leader in fx citing strength in pricing across a variety of vanilla products. They also lauded the expansion of its electronic platforms over the past 12 months. The firm rolled out a platform which can auto-quote swaps of Fenics’ request-for-quote system, one of only three firms currently capable of doing so. The firm was also praised for its eFX offering, which last year launched a new capability for institutional and corporate clients to trade fx options electronically. The team is run by Tom Gillie, global head of fx options.