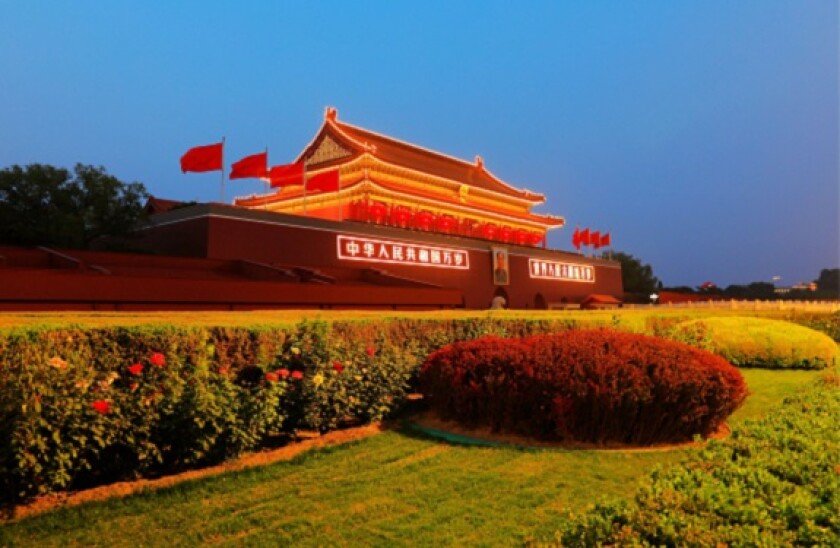

China will hold its annual “Two Sessions” meeting — the country’s most important political event of the year — on May 22. This year’s meeting was delayed by two months because of the Covid-19 pandemic. The legislative session is usually held in March.

During the Two Sessions, the country’s highest political authority, the National People’s Congress (NPC), and China’s top political advisory body, the Chinese People’s Political Consultative Committee, will meet and set the annual gross domestic product, consumer price index and fiscal deficit targets.

The decision to hold the meeting in May was made by the NPC Standing Committee last week.

“The decision to have the Two Sessions in late May also seems to be a sign that the leadership is reasonably confident about the control of the virus,” Yu Song, chief China economist at Beijing Gao Hua Securities, wrote in a note last Thursday.

*

Agricultural Bank of China (ABC) has received approval from the China Banking and Insurance Regulatory Commission (CBIRC) to issue perpetual bonds worth no more than Rmb120bn ($17bn), the bank said last Wednesday.

Separately, Bank of China sold Rmb40bn of perpetual bonds at a coupon rate of 3.4% on Thursday last week. The bank will use the proceeds to replenish its additional tier one capital.

*

China’s official manufacturing Purchasing Managers’ Index (PMI) fell to 50.8 in April from 52.0 in March, according to data published by the National Bureau of Statistics.

While production and new orders sub-indices declined slightly to 53.7 and 50.2 in April from 54.1 and 52.0 in March respectively, the new export sub-index suffered a sharp drop to 33.5 in April from 46.4 in March.

Caixin’s manufacturing PMI, which focuses on small and medium-sized enterprises, fell to 49.4 in April from 50.1 the previous month.

Official non-manufacturing PMI rebounded to 53.2 in April from 52.3 in March.

“The market’s optimism of a quick recovery in China is fading, and Beijing may have to step up its policy support, which focuses more on financial relief to help enterprises, banks and households survive the pandemic,” Ting Lu, chief China economist at Nomura, wrote in a Thursday note.

*

China’s March international trade in goods and services recorded receipts of Rmb1.432tr and payments of Rmb1.335tr, based on statistics of balance of payments, indicating a surplus of Rmb97bn, according to the State Administration of Foreign Exchange (Safe).

In dollar terms, the numbers stood at $204.3bn, $190.4bn and $13.8bn, respectively, Safe data showed.

*

Outstanding property loans in China for the first quarter of 2020 climbed by 13.9% year-on-year to Rmb46.16tr, data from the People's Bank of China (PBoC) showed. That increase, however, was 0.9 percentage points lower compared to what was recorded at the end of 2019.

According to the central bank, the pace of increase in outstanding property loans has slowed down for 20 consecutive months.

*

JP Morgan has applied to the China Securities Regulatory Commission (CSRC), the country’s top securities regulator, to lift its 49% stake in its futures joint venture to 100%.

Shenzhen Wallace Rand Equity Investment Fund Management holds a 50% stake in the JV and a venture capital firm in the Jiangsu province holds 1%.

The US bank is also seeking full ownership of its Chinese fund management JV — China International Fund Management Co. JP Morgan Asset Management currently holds 51% of the venture.

*

Mengshang Bank, a new bank set up to replace the failed Baoshang Bank, completed its final registration last week. Baoshang Bank was bailed out by the PBoC and CBIRC last May due to credit risk.

The PBoC’s deposit insurance fund will be the largest shareholder in Mengshang Bank, holding 27.5% of its shares, according to a statement published by the old Baoshang Bank last Thursday. The government of Inner Mongolia will be the second-largest shareholder with a 16.67% stake, while Anhui-based Huishang Bank will take 15%.

Retail customers’ deposits at Baoshang will be protected by the central bank’s deposit insurance fund, the PBoC said. Baoshang Bank’s wealth management products, loans and fund services will be managed by Mengshang Bank and Huishang Bank.

*

Another beleaguered Chinese lender, Bank of Jinzhou, said it will apply to the stock exchange of Hong Kong to delay publishing its audited 2019 annual results. This is due to disruptions in the auditing process from some travel restrictions in China relating to Covid-19, the bank said.

It plans to release the results by June 30.

*

Shandong-based Hengfeng Bank, which skipped publishing its annual results in 2017 and 2018 due to a restructuring, has announced its 2019 results.

The troubled lender reported a drop in its non-performing loan (NPL) ratio to 3.38% at the end of 2019 from 28.44% a year ago. The plunge came after the troubled lender disposed Rmb148.6bn of NPLs last year.

Its revenues in 2019 stood at Rmb13.76bn, with net profits attributable to shareholders at Rmb661m.

*

The CSRC said listed companies and public bond issuers can continue to quote financial results ending the third quarter of 2019 in their bond prospectus, until they can release full year results. This should not be later than June 30.

*

The securities regulator lowered the market value threshold for red-chip companies — mainland Chinese companies registered abroad — to list China Depositary Receipts (CDRs) onshore. The regulator also added some soft criteria.

Previously, only red-chip companies with a market capitalisation of at least Rmb200bn could issue CDRs onshore. Now, those with a market cap of no less than Rmb20bn and those with self-developed and world-leading technologies, strong science and technology innovation ability and competitive advantages in the industry, can also issue CDRs, the CSRC said.

*

China exported over Rmb71.2bn of goods related to fighting the Covid-19 pandemic between March 1 and April 30, according to the General Administration of Customs. These include surgical masks, protective suits, gloves, coronavirus testing kits, thermometers and ventilators.

*

The US secretary of state, Mike Pompeo, said he has seen “enormous evidence” that the novel coronavirus originated from a laboratory in Wuhan, the former epicentre of the pandemic. US president Donald Trump this week threatened to raise tariffs on Chinese goods.

Wuhan’s GDP for the first quarter of 2020 declined by 40.5% year-on-year.