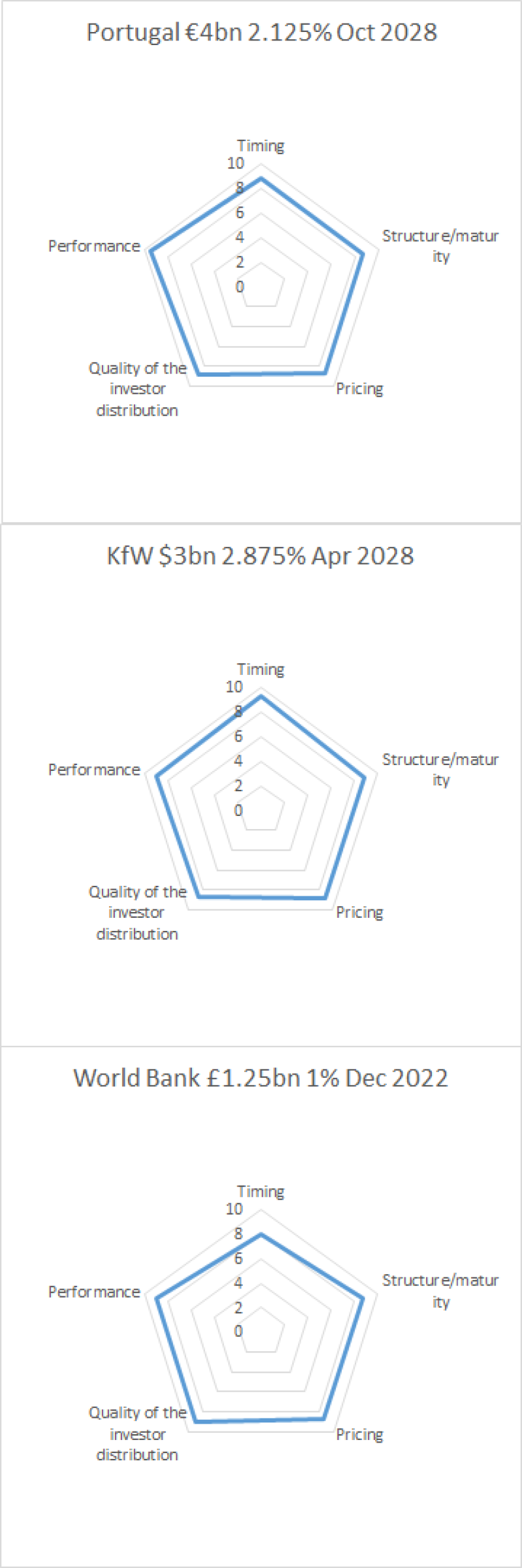

A €4bn October 2028 from Portugal, which was priced on January 10, achieved the highest average score across the five deal categories available for voting (timing, pricing, structure/maturity, quality of the investor distribution, performance). Voters awarded it an average mark of 8.94, with particularly high scores in the performance category.

The deal, which was led by Barclays, Citi, Crédit Agricole, Goldman Sachs, JP Morgan and Novo Banco, was Portugal’s first 10 year benchmark in a year. It came with a coupon 2% lower than its effort the previous year and attracted the sovereign’s largest ever book.

The top scoring dollar deal, which placed second overall, was a 10 year print from KfW — and one of two appearances from that borrower in the top five. Bank of America Merrill Lynch, JP Morgan and TD Securities priced the $3bn 2.875% April 2028 on January 24. It was the German agency's first 10 year deal in the currency since April 2015.

Our voters awarded it an average score of 8.93, with the highest scores in timing and performance.

A sterling deal made it into the BondMarker top five for the month: a £1.25bn World Bank December 2022. Barclays, HSBC and NatWest Markets led the deal, which achieved an average score of 8.70.

January was a strong month for sterling issuance, with several deals attracting enough demand to print £1bn — well above the typical size of a sterling benchmark from a public sector issuer.

The average deal score overall in January was 7.82. Dollar deals performed better on average on BondMarker — with an average score of 8.04 compared with 7.63 for euros.

| Top five deal scores: Overall |

Average score |

Leads |

| Portugal €4bn 2.125% Oct 2028 |

8.94 |

Barclays, Citi, Crédit Agricole, Goldman Sachs, JP Morgan, Novo Banco |

| KfW $3bn 2.875% Apr 2028 |

8.93 |

Bank of America Merrill Lynch, JP Morgan, TD Securities |

| Spain €10bn 1.4% Apr 2028 |

8.83 |

Barclays, BBVA, Citi, HSBC, NatWest Markets, Santander |

| World Bank £1.25bn 1% Dec 2022 |

8.70 |

Barclays, HSBC, NatWest Markets |

| KfW €5bn 0.625% Jan 2028 |

8.62 |

BNP Paribas, Commerzbank, Goldman Sachs |

| Top three deal scores: Euros |

Average score |

Leads |

| Portugal €4bn 2.125% Oct 2028 |

8.94 |

Barclays, Citi, Crédit Agricole, Goldman Sachs, JP Morgan, Novo Banco |

| Spain €10bn 1.4% Apr 2028 |

8.83 |

Barclays, BBVA, Citi, HSBC, NatWest Markets, Santander |

| KfW €5bn 0.625% Jan 2028 |

8.62 |

BNP Paribas, Commerzbank, Goldman Sachs |

| Top three deal scores: Dollars |

Average score |

Leads |

| KfW $3bn 2.875% Apr 2028 |

8.93 |

Bank of America Merrill Lynch, JP Morgan, TD Securities |

| ADB $1.5bn 2.75% Jan 2028 |

8.48 |

Goldman Sachs, JP Morgan, Nomura, TD Securities |

| IADB $3.75bn 2.5% Jan 2023 |

8.24 |

Bank of America Merrill Lynch, BMO Capital Markets, RBC Capital Markets, TD Securities |