KfW’s first 10 year dollar benchmark in almost three years was the high scorer this week, closely followed by another 10 year, this time in euros, from Spain.

KfW’s $3bn 2.875% April 2028, which was priced on January 24 by Bank of America Merrill Lynch, JP Morgan and TD Securities, was its first dollar benchmark in the 10 year part of the curve since April 2015.

Bankers away from the deal heaped praise on it at the time of execution. One told GlobalCapital: “I love that trade. I’m sitting on the sidelines feeling very jealous.” Another called it “an absolute blow-out”.

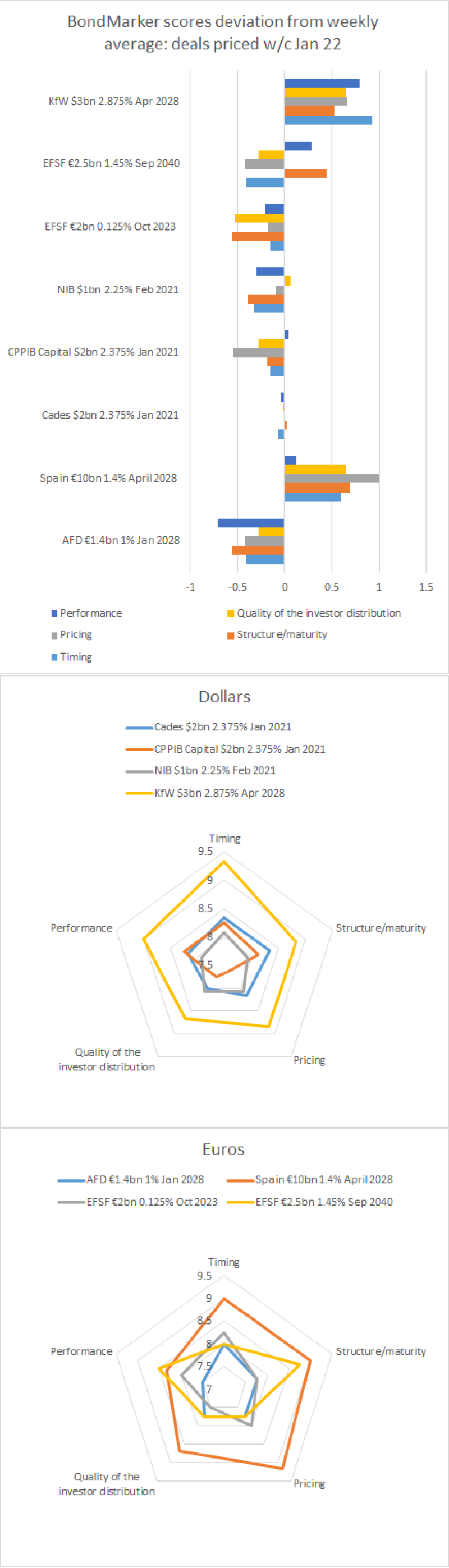

KfW’s deal had an average score across the five deal categories (timing, structure/maturity, pricing, quality of the investor distribution, performance) of 8.93. It achieved particularly high scores in the timing and performance categories.

Spain also found favour with the voters with a 10 year, this time in euros. The €10bn 1.4% April 2028 attracted what is thought to be a record book for a sovereign: €43bn. Bankers away from the deal at the time of pricing called it “super-impressive” and “a fantastic result”. Barclays, BBVA, Citi, HSBC, NatWest Markets and Santander were leads.

Voters gave it an average score of 8.83, with its highest score in the pricing category.