European banks indulged in a flurry of M&A activity in 2025, with more deals expected in 2026, fuelled by regulatory factors and falling interest rates driving a need to diversify income sources.

“2025 was a record year for banking M&A with deal volumes in the first half of the year already surpassing what we saw in all of 2024, helping to put the industry on track for the strongest year in a decade,” says Ronan O’Kelly, a partner and head of M&A, Europe at Oliver Wyman.

The return of European bank M&A comes amid a wave of financial sector deals. According to Dealogic data, by mid-October, there had been $410bn of financial sector M&A globally, across close to 2,000 deals. Volumes were up 74% compared to the same period last year.

“What stands out is the growing sense of preparedness to pursue larger deals,” says Richard Crosby, a partner in the London financial institutions group at Clifford Chance. “While not all have succeeded, the willingness is clear.”

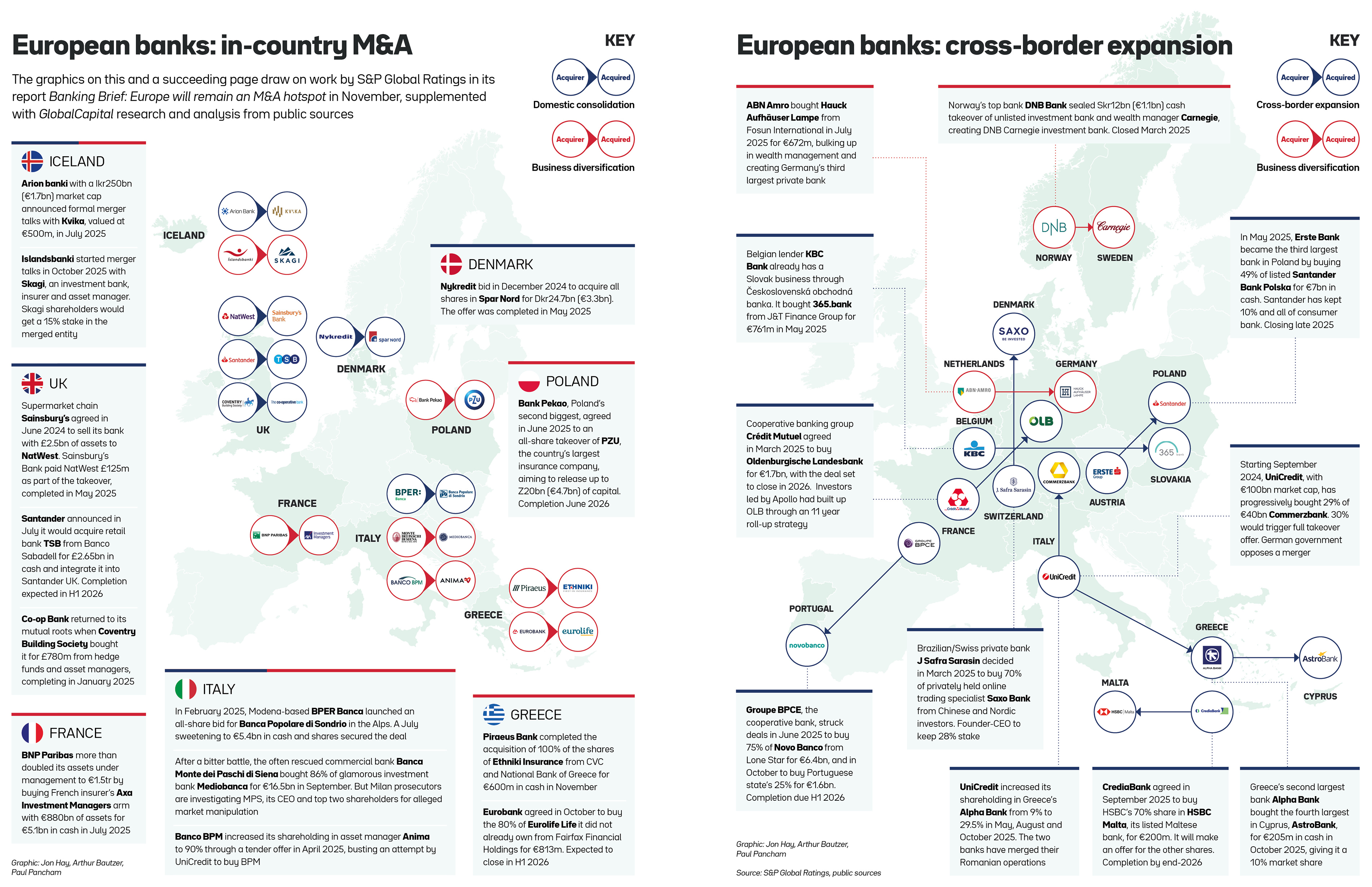

Also notable has been the diversity of deals. The year saw national and cross-border mergers of universal banks, as well as moves to diversify businesses into investment banking, insurance and asset management.

The merger wave follows the long reconstruction of the sector after the 2008 global financial crisis and the eurozone crisis that followed.

Since the European Central Bank’s decisive intervention in the summer of 2012 to do “whatever it takes” to save the euro, in the words of its then president, Mario Draghi, European banks have made a slow but decisive recovery, which is now being reflected in higher returns and valuations.

“European banks have reported significantly improved earnings generation in the last two years, supported by the high interest rate environment and improving risk profile on the back of continued progress reducing the stock of non-performing loans,” says Maria Rivas, senior vice-president, European financial institutions at Morningstar DBRS.

Hyder Jumabhoy, a partner at White & Case and global co-head of the firm’s financial institutions industry group and EMEA co-head of its financial services M&A practice, says Europe’s top 20 banks “have generated about $600bn of excess capital over the past three years.

“Not all of that capital can be returned to shareholders through share buy-back programmes, dividend payments and other forms of returns,” he adds. “Retained capital could be inefficient if not effectively deployed.”

Excess capital is expected to remain plentiful. O’Kelly says European banks “are set to generate over $500bn in excess capital over the next three years and are increasingly deploying that on M&A. With many of the deals announced this year promising return on investment in the high teens, compared to [share] buy-backs at 11%-12%, it is clear to see why M&A is in favour.”

European banks’ improved capital position is the most regularly referenced driver of increased M&A. Others include fragmented markets, the need to scale and digitalisation.

“The drivers are similar to what they have been in the past, including national consolidation and non-core disposals,” says Crosby.

“Many European banking markets are still quite fragmented, particularly across Germany, Poland, Italy and Spain,” says Jumabhoy. “It is not a surprise that each of these markets has been a bright spot for bank M&A activity.”

Italy was particularly active, undergoing what Giuseppe Rumi, a partner at law firm BonelliErede and leader of the firm’s banks focus team, calls “an unprecedented period of consolidation”, with over €30bn in transactions, led by Banca Monte dei Paschi di Siena’s acquisition of Mediobanca for €16.5bn.

For Rumi, banks see “a strategic imperative for scale and operational efficiency to secure enhanced long-term profitability for shareholders”.

Another driver is the EU’s passporting regime, which is driving activity between the EU and UK. “One of the drivers is the opportunity for non-EU banks to set foot in France to rely on the EU passport opportunity,” says Jean-Patrice Labautière, office managing partner at law firm Bryan Cave Leighton Paisner’s (BCLP) Paris office. “Indeed, nearly six years after Brexit, some of our UK clients consider that it is a good time for them to rejoin the EU market thanks to the EU banking passport.”

“While UK banking licences are no longer passportable across the European Economic Area, the UK and European banking markets in many ways remain symbiotic,” says Jumabhoy. “Many banks need access to both markets to provide a genuine pan-European offering.”

The need to invest in digitalisation has also driven acquisitions. “While some banks have built their technology stacks, others have focused on acquiring best-in-class tech businesses,” says Jumabhoy.

Average price/book ratios of EU and US banks

Average price/book ratios of Euro area banks is back to one

Data is based on the EURO STOXX Banks index, which covers 28 banks in the euro area and the KBW Bank index, which comprises 23 banks in the US

Source: UniCredit Investment Institute

The political factor

Political opposition to consolidation, often over concerns about associated lay-offs, has remained a barrier to the largest deals, both cross-border and domestic.

“There is significant political opposition to cross-border and even domestic M&A involving national or regional champions,” says Duncan Bellamy, M&A partner and co-head of financial institutions group at A&O Shearman.

The Italian government used its ‘golden power’ framework, which gives it an effective veto on transactions in strategic sectors, to impose conditions on UniCredit’s acquisition of Banco BPM, which ultimately failed.

Political opposition was also said to have played a part in the failure to tie BBVA and Banco Sabadell together, a deal that the latter’s shareholders rejected.

“In the case of BBVA-Sabadell, the Spanish government imposed stricter conditions for the merger to take place, such as the requirement for separate legal entities to be maintained for at least three years, and extendable to five years, following the closure of the transaction,” says Rivas. “[This] significantly reduced the potential cost synergies of the transaction.”

But Jumabhoy plays down the extent of political intervention in bank M&A. He believes meeting regulators’ demands is the key to transactions going ahead. “Despite press speculation concerning potential deployment/non-deployment of golden powers in some markets, the real focus should instead be on delivery of robust regulatory application and approval strategies,” he argues.

Graphic: European banks' in-country M&A and cross-border expansion

(Click to enlarge)

Cross-border challenges

As for cross-border deals, there have been several small and medium-sized tie-ups, but none of the 50 largest European banks by assets have merged.

While UniCredit under CEO Andrea Orcel is continuing its pursuit of Commerzbank, led by Bettina Orlopp (pictured above), the German government has made its opposition to the deal clear.

The UniCredit deal would in any case be an unorthodox cross-border consolidation, as synergies would come from integrating Commerzbank with UniCredit’s German bank, HypoVereinsbank.

The problems are not just political. There are institutional and regulatory barriers to cross-border tie-ups. “Cross-border banking consolidation continues to be challenging, particularly when merging large banking groups, and which we consider in part due to the lack of progress in clarifying the rules for mergers at European level,” says Rivas.

“This includes little progress in clarifying the requirements for bank mergers and in completing some of the key aspects of the European Banking Union, such as the creation of a European deposit guarantee fund or European deposit insurance scheme, facilitating a single capital market as well as setting up a European liquidity backstop of last resort, that could act as a safety net in case mergers do not go as planned.”

Among the larger tie-ups this year which did go through was Austrian bank Erste Group’s purchase of a 49% controlling stake in Santander Bank Polska for €6.8bn in May.

Erste took advantage of Santander’s reorientation of its business towards countries where it is already well established.

The Spanish bank was also active in the UK. After rejecting an £11bn offer for its UK retail business from NatWest, Santander expanded its local presence with the acquisition of TSB from Sabadell for £2.65bn in October.

Bellamy at A&O Shearman, which advised Santander on the acquisition, says this was “a particularly strategic deal for both Santander — who reinforced their commitment to the UK market following their rejection of approaches by NatWest and Barclays for their UK business — and Sabadell, being an important part of their successful defence strategy to the failed hostile takeover by BBVA.

“This deal highlighted the dynamic nature of the current market and the clear appetite for M&A from a number of major banking groups in the UK and continental Europe.”

Two private equity-owned banks, which had been considered potential IPO candidates, were instead sold to French banks: BPCE bought Portugal’s Novo Banco for €6.4bn, while Germany’s Oldenburgische Landesbank went to Crédit Mutuel for €1.7bn.

There is no clear consensus as to whether cross-border or domestic M&A will be more prevalent next year.

“Large scale cross-border M&A is going to continue to be challenging, but smaller scale is still there to be done,” says Crosby.

“We are optimistic that bank M&A activity will continue in 2026,” says Bellamy. “We think this is likely to be focussed on domestic consolidation, but there is clearly appetite for transformative cross-border M&A, albeit with significant challenges to execution.”

Jumabhoy is also optimistic: “Cross-border M&A will continue, alongside domestic and regional consolidation.”

O’Kelly at Oliver Wyman believes cross-border deals will capture a growing share of attention. “The focus will be increasingly shifting away from domestic consolidation as many European markets are relatively concentrated, though not as a region overall, to cross-border consolidation,” he says.

“I expect further M&A at national level,” says Rumi, “particularly in EU member states where the banking sector remains highly fragmented. Cross-border deals, on the other hand, may reasonably occur if the acquiring bank already has a presence in the target market — thus making it a scale-up rather than entering a new market from scratch — or if it is looking to support strategic diversification towards digital and capital-light business models.”

Hope from SIU

Some market participants hope the Savings and Investment Union (SIU), the European Commission’s latest effort to break down barriers between EU member state capital markets, could drive more mergers.

Fitch said in the summer it expects that “if successful, the SIU project could provide medium-term benefit for large and diversified banks that can combine a retail and commercial banking activities to gather savings with a [commercial and investment banking] business, which is able to structure and market securitisation to distribute it to large investors or to their insurance and asset manager.

“The SIU could fuel additional bolt-on acquisitions in asset and wealth management and insurance. We think this trend might lead to larger conglomerates that could dominate the European financial industry.”

The renewed drive to integrate the EU’s capital markets and to finish Banking Union could be an indirect driver of M&A, says Rumi. “The creation of a truly pan-European marketplace could generate new economies of scale and provide the economic rationale that banks currently lack for cross-border deals,” he says.

“Indeed, breaking the structural link between banks and their home countries would foster trust among all member states and make cross-border M&A more politically feasible.”

Labautière believes the implementation of EU legislation agreed last year could have an impact. He points to the latest amendments to the EU Capital Requirements Directive (CRD VI). “There is a narrow provision included in CRD VI (Article 21c) which may have the effect of drastically changing how non-EEA lenders go about lending and providing other core banking services to EEA clients,” he says.

Previously, in some EU countries, including Germany, third-country banks without local branches or subsidiaries could still provide banking services if they were considered subject to regulations comparable to EU and national ones.

Article 21c ends this option. From January 2027, financial institutions will only be able to provide ‘core banking services’ if they have established a licensed branch in the EU.

“This Article 21c may have an impact on the cross-border banking services and potentially cross-border consolidation,” says Labautière.

Catch a falling rate

Banks have benefited from higher interest rates in recent years, which has boosted net interest margins. Central banks are now cutting rates. The ECB forecasts inflation will undershoot its 2% target in 2026, increasing the probability of more rate cuts next year.

That could drive banks to diversify away from interest rate-based sources of income by buying fee generating businesses, such as insurance and asset management.

“You’ll see that trend continue, provided it’s the right deal,” says Crosby. “Morgan Stanley has done this really well in recent years with deals like Solium Capital, E*TRADE, Eaton Vance and more recently EquityZen.”

“With private equity exits anticipated in the wealth management space, we see high interest in an increasingly scarce set of targets,” says O’Kelly.

According to Jumabhoy, this is just “the first wave” of bank M&A. “We have not yet seen the peak; 2026 and 2027 are expected to be busy bank M&A years.”