All quiet on the inflation front? Why, yes, to some extent, for Asia, and a resounding no for EMEA. That seems to be the conclusion of a Bank of America Merrill Lynch (BoAML) report, published on Tuesday, if the commodity price outlook is anything to go by.

Here's the tale of two inflation dynamics, as foretold by BoAML:

| Although oil prices remain at relatively elevated levels, global inflation is entering a period of favorable energy base effects. However, the different ways that regional EMFX has responded over the last year entail some differentiation for Brent crude prices in local currency terms; therefore regional inflation dynamics may diverge. EM Asia is likely to benefit the most from this easing in inflationary pressures; this should provide more room for monetary policy to become growth- friendly, something which should underpin regional EMFX.

...Since the end of 2010, Brent crude prices have risen by nearly 17%. However, after peaking at approximately $127/barrel in April 2011, the price of Brent has fallen to $111/barrel...Oil prices look quite differently when seen in local currency terms across the various regions.

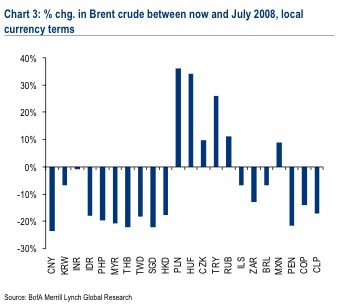

Chart 3 compares current oil prices (expressed in local currency) with those of summer 2008, when Brent crude peaked at above $140/barrel. While EM Asia and LatAm prices exhibit a broad based decline relative to 2008 prices (except Mexico), the significant weakening in EEMEA FX (due to its close links with the Euro area) has resulted in oil prices being higher in local currency terms. On a GDP-weighted basis, Brent prices in local currency are now 17% lower in EM Asia, 4% lower in LatAm but 15% higher in EEMEA. |

|

|

And going forward:

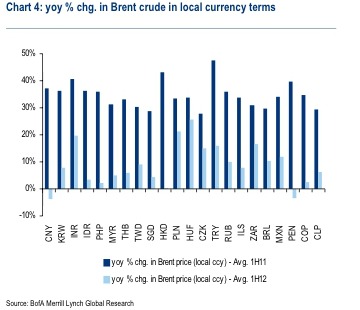

| This divergence is corroborated when we look at base effects, expressed in local currency terms (Chart 4). Using prices from Brent crude futures and our BofAML FX forecasts, we calculate expected paths for oil prices expressed in each country’s currency; we are then able to compute an average expected year over year percentage change for oil prices in the first half of 2012. All regions are expected to experience a positive impact on their annual inflation readings on the back of annual energy inflation rate falling significantly relative to last year; however, this fall is more pronounced in EM Asia and less so in EEMEA. |

| Favorable base effects will alleviate price pressures and should push GEM inflation lower in 2012; we maintain our forecast for 5.4% this year but think that regional and country differentiation will become quite evident with EEMEA inflation proving stickier relative to other regions; especially in Hungary, Poland, Turkey and South Africa. |

If oil prices remain relatively stable – and weaker compared to last year – that would provide some breathing room for energy-intensive corporates, in Asia especially, that have previously been caught off-guard by imbalanced hedging positions.

Here is another conclusion from BoAML:

| Easing energy base effects, alongside currency strength is likely to provide more room for growth-friendly policies in emerging Asia. As a result, we maintain our view that EM Asia will remain the region of choice in terms of foreign flows, something which should provide support for regional currencies in the medium term. |

Historically, however, the correlation between weaker commodity prices and market performance is somewhat counter-intuitive. Take Asia, for example. Despite the fact that, as a whole, the region is a net oil importer, a high commodity price environment tends to correlate with strong performance on export-led Asian markets, since it often reflects decent global growth prospects and robust global industrial production.

For example, according to a Citigroup report published in June, the correlation between the CRB index, the Thomson Reuters/Jefferies-backed commodity price benchmark, stood at 0.91 between January 2010 and July 2011, the second-strongest correlation score after EMEA at 0.93.

That was by no means a one-off. By individual equity market, the highest correlations with commodity prices over the past 10 years have been with Asian equities – led by South Korea, Malaysia and Taiwan – followed by the usual suspects: Russia and Mexico, according to the Citi report.

It’s all about growth models. The likes of Turkey, Hungary and India are more defensive to lower prices, since they are major commodity-importers and markets are more geared to domestic consumption/investment trends.

However, this BoAML report seems to imply that an environment of weaker oil prices in local currency terms relative to last year – if that’s not followed by an abrupt strengthening of the dollar and capital flight – would help Asian markets outperform in 2012. That sounds intuitive given the allure of relatively low debt levels, growth outperformance and monetary stimulus. All buoyed by a weaker inflation picture. Quite a volte-face from 2011, then.