Morgan Stanley, Blackstone, Pimco, Ashmore and Alvarez & Marsal were among the prestigious firms that hammered out, over four months to April, an arduous restructuring of $1.4bn of debt. Afren, mainly active in Nigeria, was teetering after the halving of oil prices in 2014.

The firms working on the restructuring had to contend with an obstinate defence of their own interests by two Nigerian banks that had lent to Afren. In the end, they conceded most of what the Nigerian banks wanted.

On April 30, with Afren hours from insolvency, the deal was agreed. Some of the company’s bolder investors injected $200m of fresh funding, as the first stage in a restructuring that would have given bondholders 89% of Afren’s equity.

Some shareholders hated the deal, feeling the company was being stolen from them, and rallied themselves to block it at an extraordinary general meeting planned for June. Even so, most felt that with its new, trusted CEO Alan Linn in place, there was hope for Afren.

But events overtook everyone involved. While the financial experts and investors wrangled over their competing claims, the viability of Afren’s oil business was deteriorating. Back in January, Afren had revealed that it had failed to discover provable oil at one of its fields, in Iraqi Kurdistan.

In mid-July came worse news: it would fail to produce as much oil as it had forecast from its working fields — according to one source, possibly for years.

On July 31 — just one year to the day after Afren’s decline began with allegations of corruption by its then CEO and COO — the company went into administration, leaving the restructuring in tatters.

Now, investors who put in $200m only three months ago risk losing even that, while older lenders of all hues will have to fight over the scraps that are left.

An oil producing company ought to have strong assets that can readily be sold to other players — but now it is unclear whether much can be recovered from the wreckage of Afren. Its claims to some of its oilfields may not prove as robust as may have been assumed.

Throughout this process, even many of those closely involved have been confused as to what was going on. Now it appears that those with the keenest incentive to understand Afren — the investors who put up new money in April — miscalculated badly.

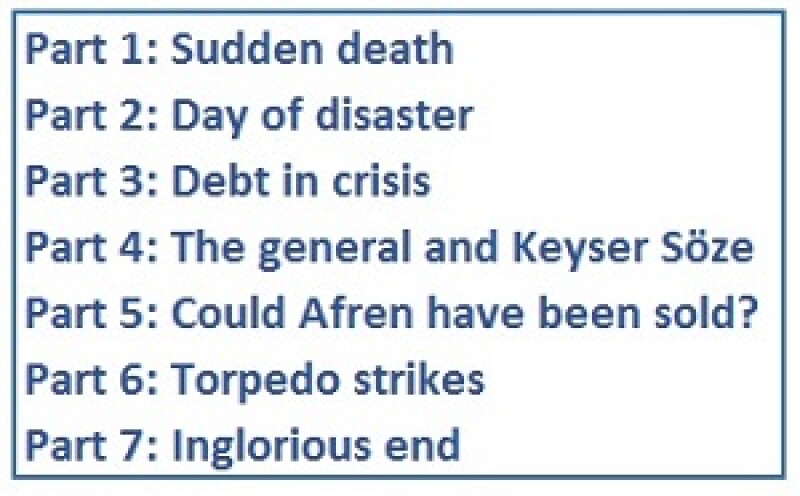

[Part 2: Day of disaster] | [Back to main page]

.

Unless otherwise stated in this article, none of the individuals and institutions mentioned agreed to comment on the record.