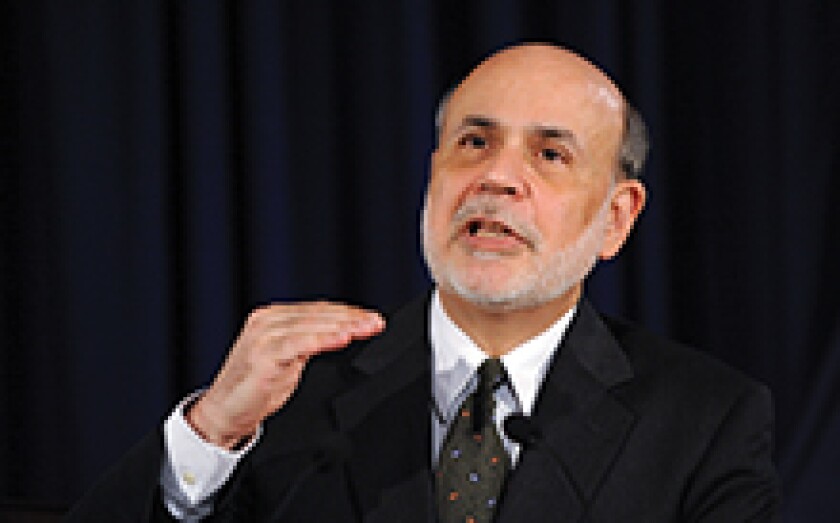

After a two-day FOMC meeting ending December 18, Fed chairman Ben Bernanke said that the US will begin to lower quantitative easing by $10bn to $75bn starting January. Although most bankers EuroWeek Asia spoke to said the cuts were announced earlier than expected (bankers were not expecting to see tapering until at least March), they were glad that QE uncertainty won’t affect issuance next month or at least until the next FOMC meeting starts on January 28.

“The markets are relieved that we now know what the devil looks like,” said a senior debt syndicate banker. “The January window looks awesome. We know what tapering looks like, and people haven’t been buying so cash balances are high.”

Bankers were also relieved to see that financial markets were responding positively to the Fed’s announcement. The Markit iTraxx Asia ex Japan index had tightened 2bp to 125bp at the time of press on December 19 from 127bp the day before, according to a debt syndicate banker, and high yield bond prices rose half a point. One banker attributed the stronger performance to the fact that rise Treasury yields, which increased 6bp to 2.89% on December 18, was less than expected.

Even investment grade bonds, which bankers and investors thought would weaken on QE tapering news amid speculation that a higher base rate and relatively lower coupons could hurt demand, saw spreads tighten as much as 10bp.

“This shows that the markets have priced in a much stronger adjustment to QE,” said another banker. “Monetary normalisation will be much more measured since Bernanke also reiterated his commitment to lower rates for longer.”

What’s hot, what’s not?

Market participants can also be relieved that underlying rates won’t be rising anytime soon, as Bernanke said they will stay near zero at least until unemployment falls below 6.5% and inflation increases to 2%. As a result, bankers say debt markets should kick off the New Year on a stable footing.

“Investor appetite remains unchanged and will continue like it did towards the end of this year,” said another senior DCM banker. “I don’t think investors will take more risk, but IG and HY will be more balanced. High yield has traded better than high grade in the past few months.”

The banker added that aside from the emergence of more Basel III bonds, the annual DCM pipeline should be in line with 2013 with issuance coming from Chinese property developers, Philippine unrated debt, investment grade issues and sovereigns. Chinese issuance should also surpass last year’s $37bn, he added, although the challenge of getting approvals from the government may mean Chinese SOEs may not be active until after Chinese New Year.

But another debt strategist said investors could still start shedding positions in longer-dated high yield Chinese property bonds on duration concerns by moving their cash out of bonds maturing in 2021 and 2023 into 2015 and 2017.

He added that Indonesian bonds, which have a stronger US investor base than peers like the Philippines, may also suffer more than other southeast Asian issuers as US buyers trade fixed income assets for equities. The Nikkei 225 was up 1.7% to 15,859 on early afternoon on Thursday. Meanwhile, the Standard & Poor’s 500 Index rose 1.7% and the Dow Jones Industrial Average jumped 1.84% after the Fed announcement.

Still, the jury is out on whether investors will be benign about buying longer tenor bonds. One debt syndicate banker said the fact that rates will remain near zero gives issuers a strong case to issue bonds of 10 years and longer, giving Sri Lanka, Philippines and Indonesia sovereign deals little to worry about if they decide to sell long-term bonds next month.

But another debt syndicate banker said that long bonds will definitely underperform versus the rest of the curve as people will be buying less on duration concerns, leaving the three-seven year tenors a safer bet.