The highest average score of the week went to Japan Bank for International Cooperation’s $1.5bn 2.75% November 2027, which notched up marks of 8.85 across the five available categories for scoring. It scored particularly highly in the timing and structure/maturity categories, hitting a nine in each.

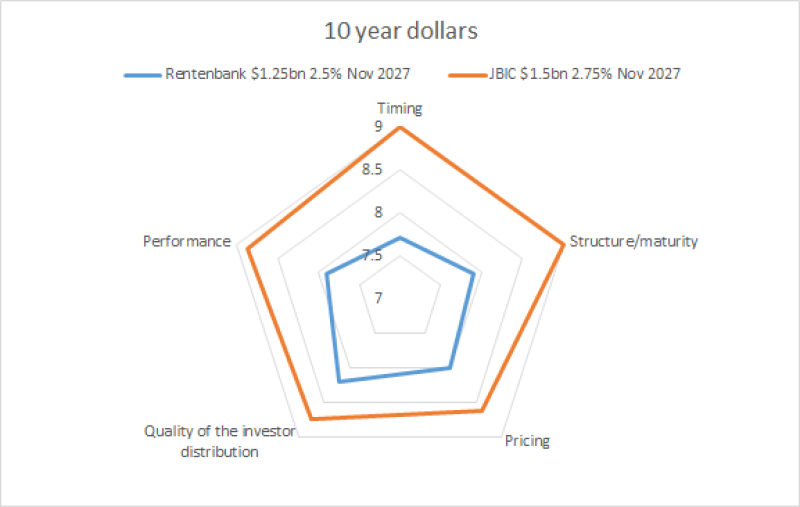

The 10 year dollar segment was the highest scoring maturity on average this week. Two 10 year deals were scored, taking an average of 8.395 across the five deal categories available for scoring (timing, pricing, structure/maturity, quality of the investor distribution and performance).

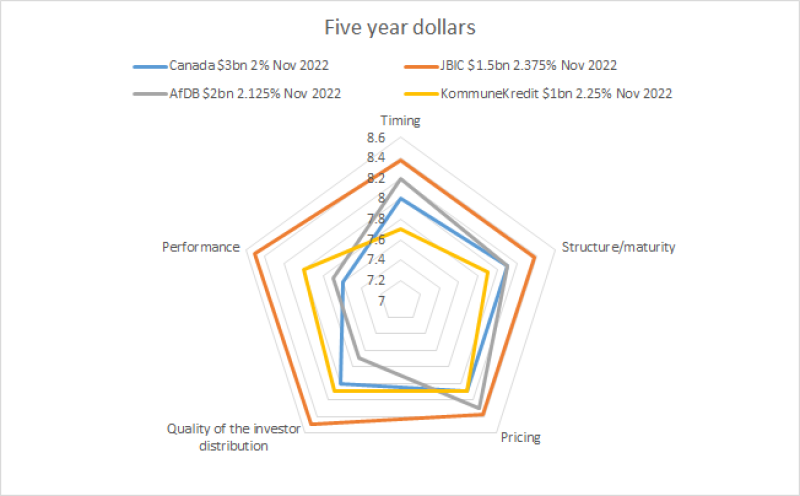

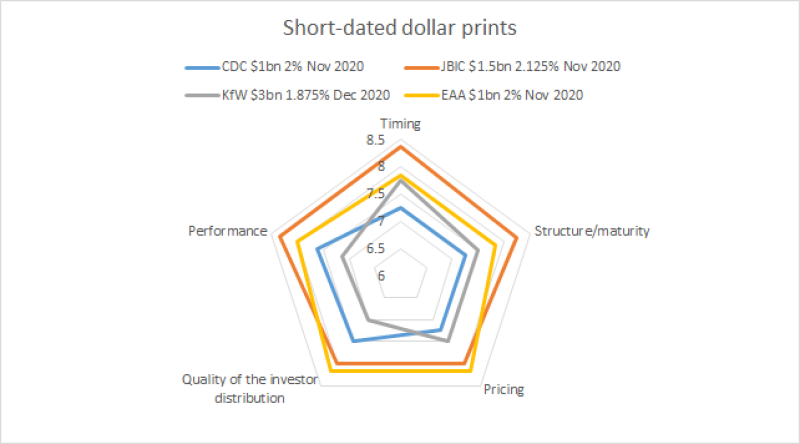

A slew of three year dollar prints — from Caisse des Depôts et Consignations, JBIC, KFW and EAA —took an average score of 7.735 while a quartet of five year trades (Canada, JBIC, African Development Bank and KommuneKredit) scored 8.087 on average.

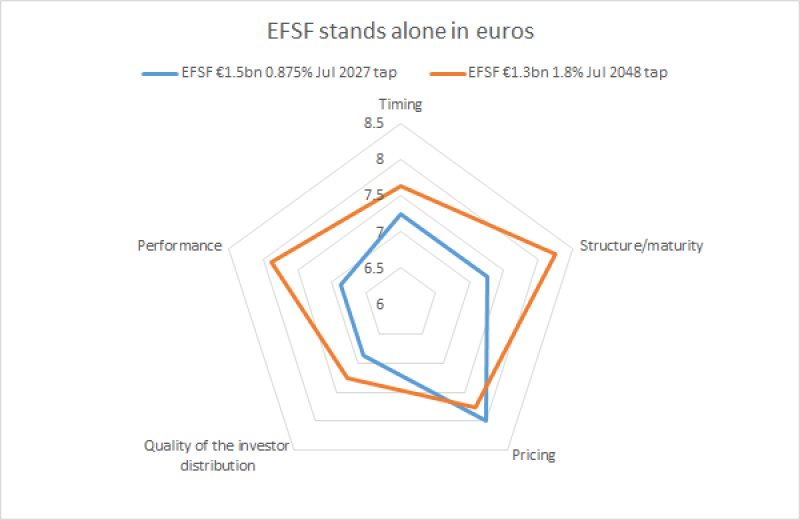

One of the least popular deals of the week was European Stability Mechanism’s €1.3bn 1.8% July 2048 tap. That fell down particularly in the quality of the investor distribution and performance categories — where it scored 6.875. But it achieved decent scores for pricing.

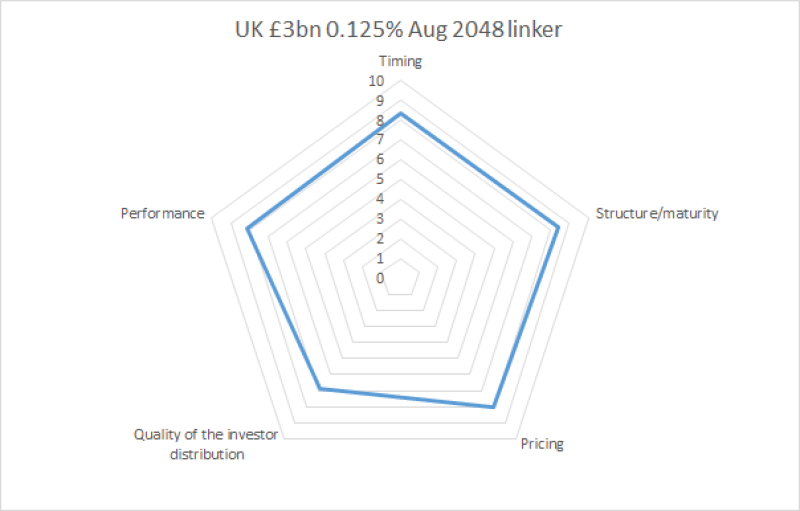

See below for a detailed illustration of scores by category.

In the new BondMarker category — Appraise the Leads — the top scoring bank group was on JBIC’s 2027 tranche, with a score of 8.5: congratulations to Barclays, Daiwa Capital Markets, Goldman Sachs and JP Morgan.

Joint second were the leads on KommuneKredit’s $1bn 2.25% November 2022 and African Development Bank’s $2bn 2.125% November 2022, with a rating of 8.375.