Americas

-

Four covered bond issuers returned to the market on Tuesday with the first deals of 2017. Two €1.5bn 10 year transactions showed that borrowers are prioritising the tougher, longer duration deals and, while conditions permit, issuing in large size.

-

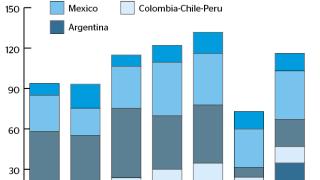

Argentina’s resurgence in international bond markets helped JP Morgan end 2016 as the top firm in primary in Latin America bond markets, up from sixth place in 2015, according to Dealogic.

-

Brazilian steel company Usiminas has given its dollar bondholders until January 12 to approve its restructuring of domestic debt, the second time it has pushed out the deadline.

-

In 2016, blockchain went from a buzzword to a ‘must have’ in financial markets, as seemingly every bank and exchange invested in projects and proofs-of-concept. But with so many asset classes having been promised big gains, 2017 begins with a dose of realism about the limits of the technology — and the challenges it poses for regulators. Dan Alderson reports.

-

The upending of global financial markets in the second half of 2016, driven by shocks from the UK’s Brexit vote and US presidential election, has caused a breakdown in previously dominant cross-asset correlations and a sharp resizing of event risk in 2017. Dan Alderson reports on a wave of structured product innovation aimed at navigating this new and more volatile universe.

-

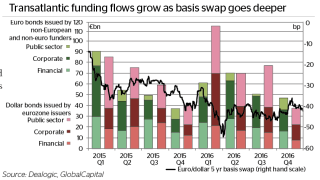

Cross-currency swap markets face a rough start to 2017. Traders fear that diverging central bank policy, a shift in corporate borrowing dynamics and a repatriation of US money will all upset the basis at different parts of the curve. Dan Alderson reports.

-

The UK’s decision to leave the European Union cast extreme uncertainty over the economy, the values and even the unity of the country. Its ramifications for domestic companies’ financing capabilities has been both more obvious and more benign, however. Max Bower reports.

-

Canada’s low debt to GDP ratio and stable politics have made it a haven in a turbulent era in global politics. But, with fears of a wave of protectionism growing, the trade-focused country faces problems ahead. However, with its fiscal stimulus programme an example to other nations wishing to promote growth, Canada’s borrowers are confident they can adapt and prosper in the new political reality. GlobalCapital hosted this roundtable in early December.

-

Donald Trump’s election as US president has shaken up expectations for this year. But although Latin American borrowers are getting used to higher funding costs, 2017 could be a year of steady progression for the market, writes Olly West.

-

The US Commodity Futures Trading Commission has given Goldman Sachs a $120m penalty for trying to manipulate dollar Isdafix and falsely reporting benchmark swap rates.

-

At around €10bn Canadian banks are expected to issue the highest net volume of euro-denominated covered bonds in 2017. And, given high dollar redemptions, a favourable cross-currency swap and an active mortgage market, supply could even beat expectations.

-

Brazilian company Suzano Papel e Celulose, which sold green bonds both internationally and domestically this year, is keen to issue more green bonds when it has eligible projects to fund, according to the company’s CFO.