Americas

-

The L Catterton-backed German shoemaker is seeking to go public

-

Spree of global local currency issuance is a reminder of a key strength in many countries in the turbulent region

-

Caribbean issuer takes $560m of seven year money as credit story shows signs of turnaround

-

Danaher spin-off water company plants its flag in the euro market

-

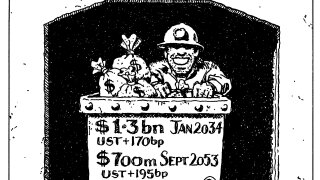

Brazilian issuer raises $850m amid petrochemical industry downturn

-

Money managers are eyeing opportunities in an asset class that is trading unusually wide to corps

-

◆ European and Asian issuers lead the charge as Barclays takes size◆ Global funding conditions shift in favour of dollars ◆ UBS returns to bond market for the first time after Credit Suisse takeover

-

US corporate bond market has exploded into life after Labor Day

-

The European market is nervously awaiting the result of bellwether deals in New York

-

JBS also sells a dual-tranche as well-known names waste no time after Labor Day

-

◆ Scotia unearths arbitrage and a greenium in Swissies ◆ Label fuels demand among asset managers for inaugural note ◆ Aktia eyes Swiss franc debut of its own

-

Semiconductor company begins deal roadshow for biggest IPO of 2023 so far