Americas

-

After assembling mega-funds that can commit loans of €1bn and more, direct lenders are gaining ground in leveraged finance at notable speed. Besides size, firms such as Alcentra, Ares, BlueBay and ICG offer borrowers privacy, speed, fixed terms and long-term commitment. But are they all equipped for the torrent of distressed situations the next downturn is likely to bring?

-

Lawyers in the US have had a busy 2019 drawing up tough documentation to protect borrowers and sponsors from CDS investors — net short activists — trying to get their say on the future of a company. With these provisions spreading to Europe, 2020 could be an even busier year

-

After the Federal Reserve’s hawkish attitude in 2018, a more dovish mood at the US central bank meant that 2019 was smooth sailing for many emerging market borrowers. However, political storms meant the turbulent asset class still threw up its share of rocks for borrowers to navigate. The GlobalCapital editorial team selected the best deals of the year, considering not just the eventual result of the trade, but the backdrop against which the deals were sold. The winners are presented here. Congratulations to those involved.

-

Five years after the US and EU slapped sanctions on Russia following its invasion of the Crimean peninsula, the country’s capital markets are doing far better than many expected. Mariam Meskin reports

-

US rate cuts were, admittedly, the driver behind the Latin American international bond market’s return to form in 2019. Although regional growth remains disappointing, there are encouraging technical and fundamental signs to be found

-

Markets go into 2020 fretting about a global recession and an escalation of tradetensions between the US and China, according to 25 heads of debt capital markets in the EMEA market, in Toby Fildes’ annual outlook survey. Respondents are mildly pessimistic on spreads and fees in the primary markets as well. But on the plus side, bankers are feeling hopeful about sustainability-themed bonds and almost unanimously believe issuance will top $270bn.

-

For corporate treasurers, the rates markets’ transition away from Libor and other Ibor benchmarks has created a messy future for their derivatives portfolios that many would prefer not to think about. Uncertain liquidity in new products and having to understand volatility in the new benchmarks are complicating the migration but there are signs of progress amid the confusion, writes Ross Lancaster.

-

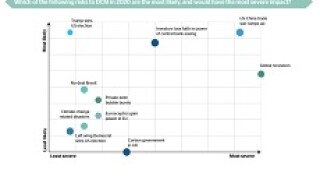

Equities are at record highs, rates at record lows; the US is quarrelling, China is slowing. As 2020 begins, participants are divided on which way markets will move. Toby Fildes picks 10 themes

-

Since the global financial crisis, central banks have accumulated powers over regulation and supervision of markets as well as over monetary policy. In 2019 politicians began to erode that with interventions that have raised questions over who should control markets. By Phil Thornton

-

The transition from one set of interest rate benchmarks to another is conceptually simple. But it is also unprecedented and has deeper consequences than many realised when Libor’s abolition was announced in 2017. With contracts worth hundreds of trillions of dollars referencing the disgraced benchmark, even small errors will have vast repercussions. PPI mis-selling? You ain’t seen nothing yet. Richard Kemmish reports

-

A friendly face in the finance ministry was apparently enough to lift Argentine sovereign bonds ahead of a looming restructuring, but analysts warned that the government was still showing no willingness to implement the austerity measures that would make debt sustainable.

-

Another Latin American borrower was set to price dollar deals this week as GlobalCapital went to press, as smaller issuers took a rare opportunity to hold the full attention of investors.