Americas

-

Secondary listings in Hong Kong got a fresh boost this week with online car marketplace Autohome pricing its deal and internet giant Baidu getting ready to roll out its transaction. More homecomings by US-listed Chinese companies are in the pipeline, but the number of viable candidates is shrinking, writes Jonathan Breen.

-

Coupang, a South Korean e-commerce company, scooped up $4.2bn from its IPO this week, after pricing the deal above the marketed range. It is the largest US listing from Asia since Alibaba Group Holding raised $25bn seven years ago.

-

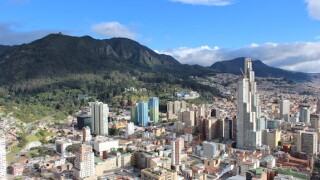

As Colombia works on the initial stages of developing a social bond framework, the sovereign has identified gender and immigration as two of its key pillars.

-

Chilean cable company VTR brought life to the Latin America primary bond market on Wednesday, but the company was unable to tighten its new senior-secured eight-year deal beyond guidance as markets are remaining functional but cautious in the face of rising US Treasury yields, said bankers.

-

The US Treasury is in the midst of a busy week, set to raise some $120bn across three auctions. Its first outing — $58bn of three year paper on Tuesday — was a success, but the 10 and 30 year outings on Wednesday and Thursday could be more of a challenge.

-

South Korean e-commerce company Coupang has increased the price range for its US IPO a day before wrapping up the deal, now putting proceeds of up to $4.08bn within reach.

-

Holders of more than 96% of Entre Rios bonds participated in a consent solicitation that will grant the issuer debt relief and see creditors abandon legal action, leaving just three Argentine provinces in default.

-

Covid-19 has made combining market-friendly economic policy with retaining popular support even trickier than usual for Latin America's politicians. In turn, it has become harder for bondholders to read the political tea leaves when weighing up where their money is best parked. For instance, investors who once loved Jair Bolsonaro's Brazil are now high-tailing it to other markets, including El Salvador, where another populist has just won power. In a busy year for LatAm elections, and with the pandemic still raging, allocating capital in the region's bond markets will be trickier than usual.

-

The rise in US Treasury yields in reaction to the government's $1.9tr stimulus package has prompted a shift in equity markets away from highly valued tech stocks that may do less well if interest rates rise as a result of higher inflation. But if the switch means investor portfolios reflect the wider economy, that is a positive development.

-

InRetail Peru Corp is looking to issue a $750m bond through its consumer division in an attempt to offer buyers greater liquidity and more diversified credit exposure than its previous bond issues, which have never exceeded $400m.

-

Zhihu, China’s largest question-and-answer platform, has set its New York Stock Exchange IPO in motion.

-

Colombia has increased its external funding programme for the year to over $10bn after forecasting a larger 2021 fiscal deficit than it recorded in 2020, exacerbating concerns about the government’s ability to maintain its investment grade credit rating.