Covered Bonds

-

Covered bond yields fell on Tuesday as Bunds rallied following a larger than expected fall in the ZEW business sentiment index and lower than expected inflation data. The European Central Bank (ECB) could be poised to commence buying on Wednesday after its scheduled meeting. Since the ECB is likely to be targeting the spread to government bonds, Pfandbriefe are likely to be on the bank’s shopping list, as they look more attractive than peripheral bonds versus their government bonds.

-

Goldman Sachs has not given up on its Fixed Income Global Structured Covered Obligation (Figsco). Despite bad publicity, the market has moved in Goldman’s favour since the deal was first announced.

-

Moody’s says the Swedish Bankers’ Association recommendation that new mortgage loans amortise down to 50% of property value, from 70% currently, will help to slow the increase in household debt and is credit positive for Swedish banks and their covered bonds.

-

Covered bond overcollateralisation must be calculated on a legally defined methodology for covered bonds to qualify for inclusion in the liquidity coverage ratio, according to the European Covered Bond Council. But this does not necessarily mean a legal minimum OC level, which should avoid amendments to national covered bond laws.

-

Coventry Building Society mandated leads to run a roadshow for its first euro denominated covered bond since October 2011. The deal is expected to offer a small premium to top UK names and is therefore likely to attract strong demand.

-

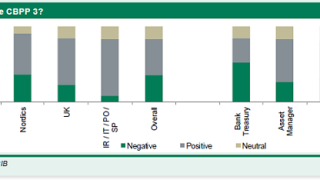

Around half of investors view CBPP3 as an overall positive, according to a Crédit Agricole survey of 89 investors published on Monday. Two thirds of investors expect the programme to have a crowding out effect on secondary markets.

-

New issue momentum picked up in the RMBS market this week as one Dutch deal was priced and another was announced, along with a sterling deal from a UK bank. However, pricing softened as euphoria over the ECB’s purchase programme began to wane.

-

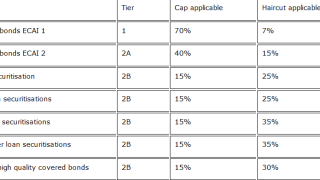

The final text of the European Commission’s (EC) Delegated Act on the Liquidity Coverage Ratio (LCR) says that covered bonds that are not rated will be eligible for inclusion into category 2B. The announcement on Friday shows that the European Commission is keen to reduce reliance on credit ratings and should be another boon for the covered bond market.

-

The Cover’s annual awards for the covered bond market were held at the Garden Palais Lichtenstein in Vienna on the evening of September 25. Please click through to see video.

-

Michel Noel, practice manager for non-bank financial institutions in the finance and markets global practice at the World Bank speaks to The Cover in a podcast interview about how the development bank assisted Brazil’s Ministry of Finance in drafting its newly released covered bond law — and which countries could be next.

-

Brazil's covered bond law entered the statute book on Wednesday, but the country faces an uphill struggle to work through the details of the legislation in time for the country's big banks to start issuing in the first quarter of 2015, the finance ministry's target date.

-

Although this week’s primary covered bond supply was limited to three deals and the near term outlook is limited by AQR results and Q3 reporting blackouts, demand reached a substantial €5.4bn of orders. Notable activity included the first public sector issue under Belgium’s covered bond law and the tightest ever Canadian euro print.