Covered Bonds

-

Czech Raiffeisenbank has mandated leads for the first publicly distributed euro-denominated benchmark Czech covered bond, which is expected to be launched following a roadshow. The transaction, which is eligible for repo with the European Central Bank and documented under English law, is likely to be followed by a string of other euro denominated Czech covered bond benchmarks.

-

Canadian Imperial Bank of Commerce has funded itself at the cheapest ever level for any Canadian bank in the euro market. The issuer, which this week priced a five year €1bn covered bond, dispensed with setting guidance and went straight from initial price thoughts to the final spread.

-

Brazilian covered bond deals will have to wait for further regulatory work to be done, despite the publication of the Brazilian covered bond law — or Letras Imobiliárias Garantidas (LIG) — on Wednesday.

-

The Brazilian Finance Ministry published its draft covered bond law on Wednesday morning, as part of a package of measures intended to spur housing finance.

-

Canadian Imperial Bank of Commerce has priced the tightest ever Canadian covered bond issued in euros. The price discovery process was also notable for skipping out guidance and going straight from initial price thoughts (IPT) to final spread.

-

Czech Raiffeisenbank has mandated leads for the first publicly distributed euro-denominated benchmark Czech covered bond, which is expected to be launched following a roadshow. The transaction, which is eligible for repo with the European Central Bank and documented under English law, could be followed by a string of other Czech covered bond deals denominated in euros.

-

Sparkasse KölnBonn opened books on Tuesday on an Aaa-rated €500m no-grow 10 year mortgage backed Pfandbrief, its first deal since April 2013 and the sixth 10 year print to come out of Germany in 2014. Bankers on the deal said they could have pushed the rare name through mid-swaps but opted not to, as the issuer wanted to leave room for secondary market performance.

-

Canadian Imperial Bank of Commerce has mandated leads for its first euro benchmark covered bond of the year. With comparable deals trading through mid-swaps, the transaction has potential to price inside Euribor, even though its bonds are not eligible for the European central bank’s purchase programme.

-

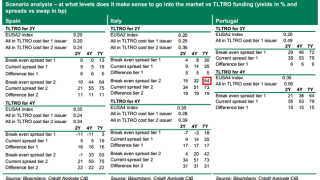

The wave of spread compression triggered by Thursday’s CBPP3 announcement is driving covered bond funding costs towards the TLTRO level across the periphery, according to analysis by Crédit Agricole’s covered bond research team in a note published on Friday.

-

Belfius Bank was set to price its first public sector-backed Pandbrieven and the first under the Belgian covered bond law on Monday. Though larger than usual, the deal was comfortably oversubscribed and was expected to price with no new issue premium.

-

In Vienna The Cover spoke to three major covered bond investors, the EBA, IMF and head of treasury at a new jurisdiction bank about the state of our global market. We hope you enjoy listening:

-

A year ago there had been virtually no corporate green bonds. After several eye-catching deals, the product is now on the radar of many treasurers at blue chip companies in a wide range of sectors, and at banks.