Covered Bonds

-

A steep rise in four year yields to more than 1% sparked investor interest

-

French firm ends long absence flat to its Swiss franc curve

-

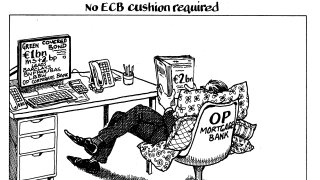

Despite less demand from the ECB, covered bond flows are in rude health

-

Deal priced inside guidance in contrast to an earlier Slovakian deal from VUB

-

Issuer’s price target was not met, but outcome was still impressive

-

Orders for the well subscribed deal continued to flood in after spread was set

-

French financial group has raised €6.5bn in the covered bond market so far this year

-

Issuing bonds set to grow tougher for weaker credits or those looking to borrow for longer

-

Bonds price flat to TD as short maturity catches central bank bid

-

Issuers urged to move quickly as further reductions anticipated

-

EU six year auction slammed as 'super-weak'

-

It was the most subscribed covered bond of this size issued since January