Venezuela

-

PDVSA is doing itself no favours by bending the truth about its financial situation. Bondholders are under no illusions about its troubles, so the company might as well be open with them.

-

Whether PDVSA bondholders choose to believe JP Morgan’s EM research team, or if they agree with the Venezuelan company’s CEO that the US bank is an “enemy of the fatherland”, they cannot have had a particularly reassuring run-up to Thanksgiving, after the borrower’s coupon payments went missing. Oliver West reports.

-

The row over PDVSA’s late coupon payments ran into Tuesday with the Venezuelan state oil giant’s CEO claiming that the company had met with “all of its bond payments”.

-

Venezuelan state oil giant PDVSA (Petróleos de Venezuela) failed to make $539m of coupon payments on three bonds last week, activating the 30 day grace period on its 9% 2021s, 6% 2024s and 9.75% 2035s.

-

Venezuelan state oil giant PDVSA finally wrapped up an exchange of bonds due 2017 for longer dated paper last Friday, but analysts said that the effect on the company’s credit quality in the medium term was negligible or even negative.

-

Venezuelan state oil giant PDVSA finally wrapped up an exchange of its short-dated debt for new notes due 2020 on Friday after accepting tenders of $2.8bn from bondholders.

-

Venezuelan state oil giant PDVSA is considering sweetening its exchange offer to bondholders in an effort to push out debt maturities, after last week’s debt swap proposal received little traction.

-

Venezuelan state oil giant PDVSA’s proposed debt swap could make its bonds an even more attractive prospect than some investors feel they already are, but economists warned it would do nothing to treat the country’s deep economic crisis.

-

UBS has hired an experienced DCM banker from a bulge bracket house to lead its Latin American bond efforts as the Swiss bank enjoys its highest league table position in the region for nearly a decade.

-

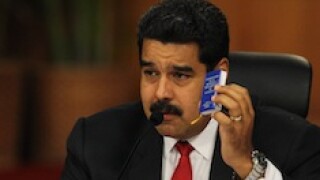

With a four hour presentation, and after two years of broken promises, Venezuelan president Nicolás Maduro finally announced economic reforms on Wednesday. But although bonds rallied slightly, analysts saw the measures as too little, too late.

-

Consensus is growing among investors and analysts that default is inevitable for Venezuela, as oil hits lows not seen in more than a decade.

-

Opposition supporters were rejoicing in Venezuela this week after their greatest electoral victory over Chavismo, but the bond market’s reaction was muted as oil plummeted to nearly seven year lows and the scale of the political and economic challenges that lie ahead loomed large.