UK

-

Nissan has done the UK a favour. By playing hardball about wanting assurances from the UK government about Brexit, it has opened the debate into one where real investments are discussed, and tough choices become apparent. The City should follow its lead.

-

Aberdeen City Council was able to raise £370m on Tuesday with a bond issue that was the first ever from a sub-sovereign Scottish borrower.

-

UK challenger bank Virgin Money Holdings is set to return to the additional tier one (AT1) market, as it looks to entice investors during a quiet week for new issuance.

-

Shares in Volution Group, the UK manufacturer of ventilation products, closed 8.4% lower on Tuesday after Windmill Holding, an investment vehicle controlled by Towerbrook Capital Partners, sold its remaining 22% stake via the third block trade since the company’s IPO in 2014.

-

Though the UK referendum in June derailed the advertising firm Exterion Media's bid for a £220m loan, the company has returned and closed the offering, cutting the deal size and ramping up the margin in the process.

-

UK pub operator Enterprise Inns on Monday printed its new sterling notes at maximum size, winning the minimum coupon that it had promised to investors.

-

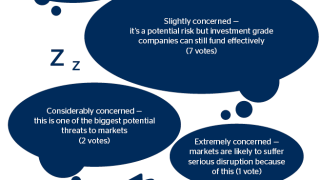

Ross Lancaster interviewed the heads of EMEA corporate debt capital markets at 11 of the top 20 banks asking their views on the market. Here are the results.

-

Mortgage lender Together on Friday accelerated the pricing of its PIK bond in a sterling market still cautious after last week’s cancellation but geared with a new offering from betting house Ladbrokes.

-

National Express, the UK coach operator, tapped the sterling bond market on Friday with a £400m seven year trade that swerved volatility in the Gilt market.

-

Singapore-listed property developer Oxley Holdings has hit the market for a $200m senior secured financing.

-

-

Amid rough going for new IPOs this week, one of this year’s star IPO performers, Maisons du Monde, was back in the market on Wednesday night as the global coordinators waived the lock-up to let the leading shareholders make their first block trade in the stock. Thursday brought a substantial trade in Ferrexpo, which owns iron mines in Ukraine, which got done, though at a slightly reduced size.