UK Sovereign

-

The UK Debt Management Office has opted to reopen an index linked Gilt maturing in 2065 for its sixth and final syndication of the 2016/17 financial year. Meanwhile, Municipality Finance opened sterling issuance for the week with a December 2020 issue.

-

-

A much anticipated UK Supreme Court ruling that would decide whether the country’s parliament should vote on the invocation of Article 50 — officially starting the Brexit process — failed to stop the sovereign building a record syndication book on Tuesday.

-

The UK Debt Management Office broke its record book size on Tuesday for the second time in three months, as it also enjoyed a healthy showing from investors outside the country.

-

The UK Debt Management Office has named the group of banks that will sell its next Gilt syndication.

-

The UK Debt Management Office has picked the maturity and timing for a scheduled bond sale later this month. Elsewhere in sterling, a pair of issuers added deals to a bumper opening week that fell just short of a record.

-

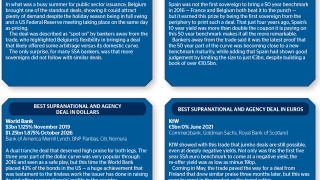

As a year where political upsets became the norm drew to a close, GlobalCapital picks the standout trades from a turbulent 2016.

-

The UK Debt Management Office has picked a conventional Gilt with a tenor in the 40 year area for a syndication it added to its 2016-17 funding programme after November’s autumn statement.

-

The UK Debt Management Office has picked a conventional Gilt with a tenor in the 40 year area for a syndication it added to its 2016-17 funding programme after November’s autumn statement.

-

-

Rising inflation expectations, as governments switch their focus to fiscal stimulus and central banks move away from extremely loose monetary policy, are boosting demand for inflation linked bonds. Opec’s agreement this week to cut oil production pushed demand even higher. But there are question marks over whether issuers will adapt their funding menus to satisfy the new appetite, writes Craig McGlashan.

-

The Italian referendum on December 4 has been lurking in SSA bankers' diaries as a dangerous risk event but, on Tuesday, rumours of enhanced European Central Bank support led to a rally in Italian government paper.