UBS

-

UBS made its first foray into the green bond market as an issuer on Monday, landing a €500m operating company deal at a level bordering on zero yield, which could embolden other lower spread issuers to follow. The visit to euros was paired with a seven year deal in the Swiss bank’s home market.

-

China’s Full Truck Alliance (FTA), billed as an Uber-style service for trucks, has raised $1.56bn from its New York IPO. A wave of global demand pushed final pricing to the top of the guidance, said a banker close to the deal.

-

Gazprom is set to access the Swiss franc market this week to sell its first trade in the currency for over three years.

-

Senior and covered bond plans were flowing into the deal pipeline on Monday, with issuers keen to buck the softer tone and print before the start of the summer break.

-

SCE Intelligent Commercial Management has hit the road with its Hong Kong IPO. It is looking to raise up to HK$2.3bn ($296.2m).

-

A trio of borrowers looked to slip in with conventional senior deals ahead of Wednesday’s US Federal Reserve meeting, with each paying a small premium to do so.

-

A reverse enquiry from an institutional investor drove Raiffeisen to reopen its Swiss franc additional tier one (AT1) note this week, which was bumped up even further by demand from retail buyers.

-

Philippine real estate investment trust MReit filed for IPO approval this week. It is targeting up to Ps27.3bn ($562.3m), which would make it the country’s largest Reit listing.

-

China’s Full Truck Alliance, an Uber-like service for trucks, launched an IPO on the New York Stock Exchange this week. It is aiming to raise up to $1.56bn.

-

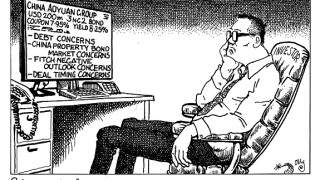

China Aoyuan Group’s attempt to woo investors to its $200m bond with a generous yield fell flat on Tuesday. Recent concerns about the property developer’s leverage, and the subsequent fall of its dollar bonds in the aftermarket, held investors back from the new deal — and caused a further spiral in secondary. Morgan Davis reports.

-

Piraeus Bank showed the depth of investor demand for high-yielding bank debt this week when it brought the first additional tier one (AT1) out of Greece with one of lowest ratings ever seen in the market. Greek banks are now expected to turn their attention to the minimum requirements for own funds and eligible liabilities (MREL), where green labels and sustainability-linked structures could help them achieve their goals.

-