Spain

-

Spanish telecoms provider Telefónica hit the euro market on Tuesday for a dual tranche offering that tested the outer limit of investors’ appetite for long tenors.

-

Equity block trading in Emea reopened on Wednesday evening with a €114m sale of stock in Parques Reunidos, the Spanish leisure park operator that was one of the poorly performing IPOs of last year. But surprisingly, other deals have not appeared.

-

Four covered bonds issuers raised almost €6bn between them at the long end of the curve this week, suggesting borrowers are prioritising tougher, longer duration deals. And while conditions permit some are issuing in the largest size possible.

-

Arle Capital Partners reopened the equity block trade market in Emea for 2017 on Wednesday evening by offering a €114m block of shares in Parques Reunidos, the Spanish leisure park operator.

-

Foncière des Murs, the French property company controlled by Foncière des Régions, will raise €200m of equity in a rights issue to partly finance its €542m acquisition of a portfolio of 19 Spanish hotels from Merlin Properties.

-

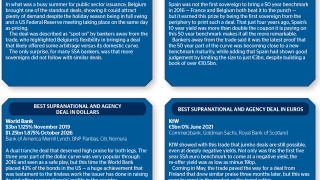

As a year where political upsets became the norm drew to a close, GlobalCapital picks the standout trades from a turbulent 2016.

-

Four covered bond issuers returned to the market on Tuesday with the first deals of 2017. Two €1.5bn 10 year transactions showed that borrowers are prioritising the tougher, longer duration deals and, while conditions permit, issuing in large size.

-

Unicaja Banco sold a €192m block of shares in Iberdrola, the Spanish electricity company, on Thursday night, in an accelerated bookbuild led by UBS.

-

CriteriaCaixa Holding, the unlisted holding company, sold another slice of CaixaBank in a €315m block trade on Tuesday night that took it a step closer to its long term goal of holding just 40% of the Barcelona-based lender.

-

Spain’s construction sector has been a sore point in the high yield market this year, with three of its big hitters either in distress, debt restructuring or increasingly surrounded by accounting disputes and corruption. Investor adviser CreditSights this week said major shareholder families behind those companies bear some responsibility.

-

Deutsche Bank’s Spanish subsidiary kept its commitment to issue around €2bn of Cédulas a year and on Wednesday launched a well-oversubscribed €1bn five year, even though the cost was much higher than the European Central Bank’s Targeted Long Term Refinancing Operation.

-

Deutsche Bank’s Spanish subsidiary kept its commitment to issue around €2bn Cédulas per annum and on Wednesday issued a well-oversubscribed €1bn five year, even though the cost was much higher than the European Central Bank’s Term Long Term Refinancing Operation.