Spain

-

Banca Monte Dei Paschi di Siena’s secondary covered bond spreads are holding firm following another downgrade, but Spanish spreads are weakening after their recent rally. Peripheral borrowers could still bring successful benchmarks, but compression between covered and senior levels means there is less incentive to use valuable collateral, syndicate bankers told The Cover.

-

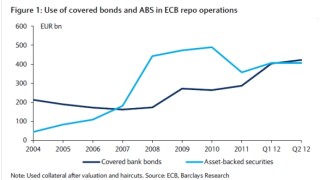

The increase in retained issuance will have a lasting impact on the primary covered bond market and could reduce benchmark supply to ‘showcase transactions’, Barclays analysts warn.

-

Standard & Poor’s cut its rating on another pair of Cédulas programmes this week, but the stellar result for Bankinter and UniCredit showed single-A rated trades can still find a stampeding demand. UK buyers bought more than expected in both deals, as syndicate leads pointed to a new class of accounts that could support peripheral transactions.

-

Bankinter on Thursday swiftly followed peripheral peer UniCredit’s success from the day before. The Spanish borrower launched a blow-out three year benchmark trade 20bp inside initial price thoughts, as traders struggled to keep up with a big spread rally in peripheral paper.

-

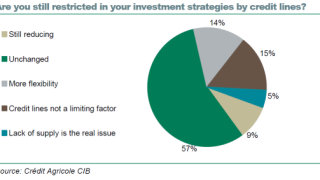

Investor sentiment towards Spain and Italy has improved since August, according to a Crédit Agricole survey. However, most buyers’ credit lines are unchanged, which means many still cannot take advantage of remarkable relative value.

-

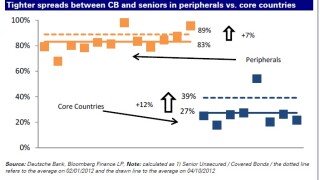

Core covered bonds are performing poorly, with low coupons putting investors off, according to Deutsche Bank analysts. Higher yielding peripheral paper could benefit as a result, but the prospect for fresh benchmark trades from southern Europe remains uncertain.

-

Investors are cash-rich and covered bond spreads look set to remain fairly stable – ideal conditions for covered bond issuance. However, deal flow is set to remain quiet as most issuers are well funded, and those that could do deals are about to enter blackout period.

-

Nearly a quarter of Spanish mortgages could be in negative equity, Moody’s has warned, but with Cédulas collateral marked at historic levels, investors have little transparency on the value of their claim. An updated covered bond structure is fully warranted, but unless it was legally enshrined, the benefit would be negligible, reports The Cover.

-

Banco Santander Totta got only a derisory take up for its RMBS to covered bond exchange — the first time a bank has offered such a swap. Meanwhile, analysts and lawyers dashed hopes for the tendering of low priced Spanish multi-Cédulas, saying that such exercises would be technically infeasible.

-

The transfer of assets to the proposed Spanish Asset Management Company (AMC) could hit Cédulas noteholders, as it would reduce overcollateralisation. However, as issuer defaults would become less likely, covered bondholders would stand to benefit.

-

Norddeutsche Landesbank could open books on a debut dollar covered bond as early as Tuesday morning, said syndicate leads on Monday. But the outlook for a first sterling trade from Deutsche Pfandbriefbank is more uncertain.

-

Despite growing concerns that a Spanish bad bank will cause collateral pools to shrink, there is a growing sense of confidence that real money Cédulas investors will not become forced sellers as bonds hold the investment grade rating threshold and the ECB dampens systemic risk fears.