Spain

-

Bankers expect more bad news to come out of Portugal and the correction being seen in peripheral covered bonds may therefore have further to go. But this bad news fundamentally does not change the positive longer term picture for the rest of peripheral Europe. A technical retracement had been long overdue and will provide a rare buying opportunity for real money investors and banks looking to cover their shorts.

-

Standard & Poor's upgraded BBVA’s mortgage backed covered bond programme from A to AA- after the European close on Tuesday, while Fitch upgraded UniCredit’s Italian programme from A+ to AA-. The upgrades take the programmes towards a level that gives regulatory benefits. UniCredit has most to gain.

-

Austrian covered bonds were steady on Tuesday after a swathe of Moody’s senior downgrades hit covered bonds, leading bankers to say its methodology has serious weaknesses. Separately, Standard & Poor's upgraded €27bn of multi-Cédulas in a move which analysts said would have little impact and could soon be reversed. The fact multi-Cédulas have outperformed Austrian covered bonds all year is due to the other factors.

-

BBVA announced that it will amortise two floating rate note retained Cédulas Hipotecarias on Wednesday. The move will increase overcollateralisation (OC) in its cover pool and could potentially result in a rating upgrade to the AA area with Standard & Poor’s, said Crédit Agricole analysts.

-

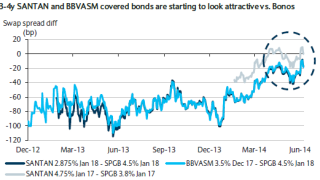

Following the June 5 ECB announcement Bonos have rallied strongly, while Cédulas have reacted to a lesser extent, leaving clear performance potential, a Barclays research note published on Thursday argues. But what is nice in theory is more difficult in practice, traders said — large blocks of Cédulas are difficult to source without pushing up prices.

-

Covered bond secondary markets opened on a much firmer footing on Friday, with dealers and clients singling out higher yielding weaker credits, particularly in the periphery, where offers are hard to find. The move came after Thursday’s stimulus package from the European Central Bank, and after Standard and Poor’s upgraded several Spanish banks.

-

BBVA returned to the covered bond market for the first time in over a year on Wednesday with a 10 year Cédulas that attracted a fairly granular book. The coupon paid was the lowest ever for a 10 year in the history of the Spanish Cedulas market.

-

Non performing loans in multi-Cédulas deals are continuing to rise according to Moody’s. And Bank of Spain data released last week showing that the trend maybe levelling off, understates the actual level by as much as half. See The Cover's interactive chart for more.

-

Spread widening in periphery covered bonds are a correction rather than a trend reversal, said Commerzbank’s research team this week.

-

Declining Spanish covered bond issuance has resulted in higher levels of overcollateralization, said Moody’s on Tuesday. This is credit positive because bondholders are better protected.

-

Spanish bank Kutxabank took advantage of improving conditions after a dismal open on Monday to issue the country’s fourth covered bond of the year. Following Swedbank and Bank of Austria last week with a seven year tenor, the deal is the first such tenor from Spain this year and a clear indication of where the sweet spot on the curve lies.

-

Many Portuguese covered bonds could have their ratings upgraded soon, after Moody’s raised the Portuguese sovereign rating last Friday. Banco Santander Totta’s most recent deal, which is a strong candidate for upgrade, was trading 8bp tighter from last week on Monday, but this was due to ECB rate cut hopes, and not credit upgrade hopes.