Singapore

-

Bank Julius Baer has made senior changes to its southeast Asia business, creating the role of vice-chairman as well as appointing a new head of private banking.

-

Citi has created a consolidated Asia Pacific debt syndicate team as it seeks to take advantage of the growing relevance of local currency markets, according to an internal memo seen by GlobalCapital Asia.

-

Tata Motors has made a rapid return to the international loan market for a refinancing worth $250m, launching the deal just a few weeks after signing a $600m fundraising.

-

Deutsche Bank has appointed Jake Gearhart as head of debt syndicate and origination for Asia Pacific.

-

India’s stock market regulator has published consultation papers on real estate and infrastructure investment trusts while Singapore’s financial regulatory authority has firmed up its rules for real estate investment trusts (Reits).

-

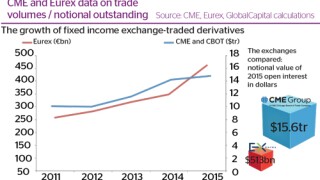

Competition between derivatives exchanges is intensifying, giving rise to a rash of product and platform launches in 2015, as well as geographical expansion. But 2016 will be dominated by regulatory deadlines for electronic trading. As Dan Alderson reports, exchanges that best prepare market participants to meet these requirements will be the ones that will win out.

-

Manulife US Real Estate Investment Trust (Reit) is reviving its plans to list in Singapore after shelving an IPO in 2015, and is aiming to launch in the first half of this year, according to a source close to the deal.

-

India’s stock market regulator has published a consultation paper on real estate investment trusts (Reits) while Singapore’s financial regulatory authority has firmed up rules governing the asset class.

-

Struggling Indonesian company Trikomsel Oke has had its debt payment obligations suspended, according to an official statement released by the firm on January 4.

-

Lippo Malls Indonesia Retail (LMIR) Trust has wrapped up a S$100m ($70.6m) term loan with three lenders.

-

A $1.5bn refinancing for Tata Steel that went into senior syndication in early December has been funded by 17 lenders.

-

The Singapore Exchange (SGX) has created a bulletin on its website that for the first time will shed light on non-public regulatory action it has taken in response to breaches of the listing rules.