SEB

-

-

-

France sold its first syndicated tap on Tuesday, adding €4bn to its GrOAT line. The sovereign will be followed in the green market by a Danish agency's sophomore offering.

-

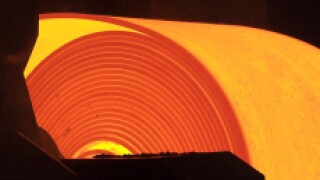

Sweden’s SSAB has ramped up the size of its euro denominated revolving credit facility to €600m, as the high strength steelmaker becomes the latest beneficiary of the liquidity flooding the loan markets.

-

Cloetta, the Swedish confectionery company, has amended and extended its euro and krona loans in an entirely Nordic banking affair, and also launched a commercial paper programme.

-

It is a mark of how far the market has come from a barren week at the end of May that not just one, but three deals, totalling €2.75bn, were priced on Friday. The European Central Bank meeting and the expectation of a deal from German pharmaceuticals company Bayer played their part in the issuers’ decisions on timing and the order books justified those choices.

-

-

Public sector borrowers looking for dollar funding are likely to have to go even shorter than they have been used to after this week’s Federal Open Market Committee meeting, said SSA bankers.

-

KommuneKredit will hit the road next week to talk up a new green bond, while a fellow Nordic issuer is looking to enter the social bond market — although not for some time yet.

-

KommuneKredit will hit the road next week to talk up a new green bond, while a fellow Nordic issuer is looking to enter the social bond market — although not for some time yet.

-

Sweden’s Lundin Petroleum has slashed 90bp off the margin of its $5bn reserves-based lending facility, as borrowers continue to heap pressure on lenders over pricing.

-

The world’s largest salmon producer, Marine Harvest, sold the Nordic fish farming industry’s first bond for five years last week and as the industry scales up sources say a wave of issuance from the sector could be on the way.