Top Section/Ad

Top Section/Ad

Most recent

Banks welcome UK’s relaxed prospectus rules as IPO pipeline swells

Originator hired to go after bank bond issues in euros and dollars

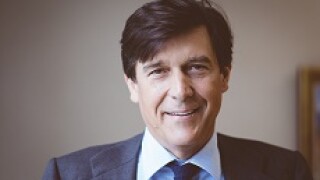

With Sergio Ermotti set to step down as group CEO, chairman Colm Kelleher favours an orderly, internal succession. But in a critical year for the bank, there could be turbulence ahead

More articles/Ad

More articles/Ad

More articles

-

UniCredit has moved its target date for issuing instruments to meet its total loss absorbing capacity (TLAC) requirement from the end of this year to the end of March next year. Meanwhile, chief executive Jean Pierre Mustier is set to invest in the bank’s equity and additional tier one (AT1) notes.

-

BNP Paribas, Crédit Agricole and Société Générale are making plans for the eventuality of a hard Brexit, in some cases putting swathes of bankers at risk of redundancy. Some DCM and sales teams have been asked to move, though each bank is taking a different approach as to who will need to be relocated to comply with EU regulations.

-

Barclays’ co-head of global debt capital markets and risk solutions group has had his job put at risk by the bank.

-

The US bank has appointed a strong line-up to run its EMEA banking operation as it looks to capitalise on its recent gains in market share, writes David Rothnie.

-

Credit Suisse made a bold claim in its third quarter numbers — to topping the table for improvement in advisory and capital markets since it started its restructuring in 2015. But despite the investment banking momentum, the bank’s shares slid on Thursday as it reported a loss in its global markets business.

-

Obscure disclosure rules for European securitizations could bring asset-backed commercial paper conduits to a sudden stop on January 1, forcing the banks that sponsor them to step in with liquidity support of up to €130bn.