Top Section/Ad

Top Section/Ad

Most recent

Banks welcome UK’s relaxed prospectus rules as IPO pipeline swells

Originator hired to go after bank bond issues in euros and dollars

With Sergio Ermotti set to step down as group CEO, chairman Colm Kelleher favours an orderly, internal succession. But in a critical year for the bank, there could be turbulence ahead

More articles/Ad

More articles/Ad

More articles

-

ABN Amro is set to boost its capital ratios through merging its operating and holding companies.

-

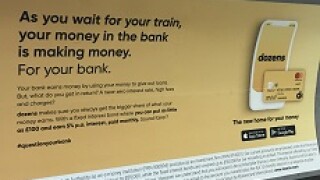

Dozens, the latest digital banking offering, aims to revolutionise retail banking in favour of the customer, by routing returns back to depositors and avoiding most unsecured consumer lending. Is this an unworkable goal, or is founder Aritra Chakravarty on to something?

-

Olaf Scholz, finance minister and vice-chancellor for Germany, said that there was 'no debate' about the creation of a bad bank in a prospective merger between Deutsche Bank and Commerzbank. He also does not believe that the recapitalisation of NordLB by the association of German savings banks would contravene EU state aid rules.

-

BNP Paribas and Société Générale both announced new plans to slim down their investment banks this week. They posted sharp drops in revenue across global markets operations that were, on balance, a bit worse than those registered so far by the rest of the industry.

-

JP Morgan has overhauled its European management team as it places its oldest franchise at the heart of a push to boost its UK M&A business.

-

Société Générale announced Jean-François Grégoire’s new job as head of the global markets business unit on Thursday, replacing Frank Drouet. The bank is seeking to slim down the operations of the division.