Organisation

-

The Ohio-based chemicals manufacturer is set to go public later this year

-

Troubled Chinese bad debt manager is set to be bailed out by five government-backed investors

-

Sponsored OcorianWhile the full financial impact of the pandemic has yet to emerge, growing signs of corporate distress are expected to start emerging in the coming months. To get ahead of it, early engagement with lenders and appointing strong advisors can help companies avoid insolvency or costly restructuring, say Ocorian’s Alan Booth, head of capital markets and Nick Bland, head of UK client services.

-

Sponsored EQ Credit ServicesEQ Credit Services has rapidly grown to become one of the leading standby servicers and technology providers of loan management systems in the UK. In an interview with GlobalCapital, Will Ellis, sales director, describes the growth story so far and future ambitions.

-

Sponsored Wiener BörseThe Vienna Stock Exchange celebrates its 250th anniversary this year, making it one of the world’s oldest stock exchanges. Its longevity and resilience, through wars, the fall of empires and financial crises, is partly due to a sound reading of, and response to, future market trends. In an interview with GlobalCapital, Matthias Szabo, director of debt listings, highlights three current trends that are shaping the future of the exchange, and the industry.

-

Sponsored OcorianActive management, structural protections and refinancing have aided the resilience of collateralised loan obligations amid a challenging period for structured finance. The increasing embrace of environmental, social and governance factors in CLOs could aid the market’s recovery and future growth, says Ocorian’s Nick Bland, head of UK client services, and Kareem Robinson, client director.

-

Sponsored CSCThe US consumer ABS market is in the middle of a balancing act, as investors cautiously look at indicators of further economic pain while also eyeing riskier assets in the hunt for yield, according to CSC and GlobalCapital’s annual securitization pulse survey.

-

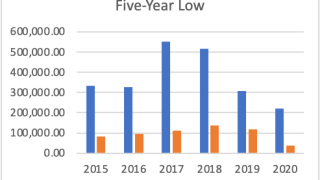

Sponsored CSCAs yields have collapsed elsewhere under pressure from central bank interventions, fixed income investors have increasingly sought higher returns in the esoteric ABS sector, according to CSC and GlobalCapital’s annual securitization pulse survey.

-

Sponsored CSCWhile it’s difficult to be positive on the outlook, securitization market participants expect only a modest increase in nonperforming loans in Europe this year, according to CSC and GlobalCapital’s annual securitization pulse survey.

-

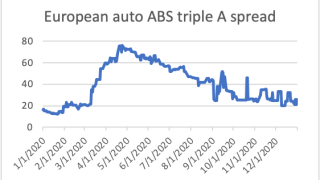

Sponsored by CSCMarket participants expect European consumer ABS spreads to remain flat or tighten in 2021, despite the potential for these deals to reflect economic stresses and rising unemployment, according to CSC and GlobalCapital’s annual securitization pulse survey.

-

Sponsored CSC2020 was an extraordinary year. It was period many would rather forget in their personal lives, but a year of outsize returns in pockets of securitized products. It was also a year that turned the outlook for securitization on its head.

-

Sponsored CabeiThe damage caused by hurricanes Eta and Iota, which slammed into the Central American states at the end of November, caused widespread damage and further misery to millions in countries that were already suffering from the Covid-19 pandemic.