OeKB

-

The public sector dollar market on Wednesday showed that it had more than enough depth to cope with a pair of issuers bringing deals in the same maturity with just a basis point of difference in initial price thoughts, as both trades came in size and at tightened pricing. Another agency is set to dip into the demand on Thursday.

-

The European Bank for Reconstruction and Development on Wednesday became the third public sector borrower to issue an inaugural Sonia-linked bond in 2019, with the deal marking the borrower’s largest sterling bond to date.

-

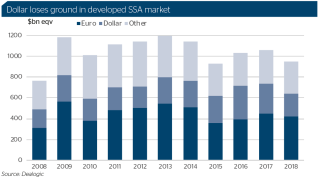

SSA euro issuance outstripped dollars this year, thanks to strong conditions in the first half and the vagaries of the basis swap. But the end of eurozone quantitative easing and political strife made it a trickier place later in 2018 — and those elements are unlikely to disappear in 2019.

-

The dollar SSA market at the end of 2018 was in stark contrast to euros, despite the latter outstripping it in volume over the year. Even uncertainty over the Federal Reserve’s rate path in 2019 seems unlikely to shake the fortitude of the currency as a funding source for SSAs. But finding windows could become trickier as the Fed pulls liquidity amid global trade wars and rising populism.

-

This week's funding scorecard looks at the progress of Europe's supranationals and agencies as the year comes to a close. Some of the issuers have also set their funding targets for 2019.

-

KfW’s €5bn November 2023 was the standout performer in a week of trades — from Erste Abwicklungsanstalt, Oesterreichische Kontrollbank and Swedish Export Credit Corp — that BondMarker voters rated highly.

-

-

A quartet of public sector borrowers brought small dollar deals this week that were fine but unspectacular, which SSA bankers said was down to a confluence of factors. There are hopes that with the market likely quiet next week for the US mid-term elections and Federal Open Market Committee meeting, conditions could return to their best for the albeit limited funding windows left in 2018.

-

Public sector borrowers are taking different approaches to the MTN market as they look to see out the rest of the funding year.

-

Österreichische Kontrollbank and Erste Abwicklungsanstalt priced well received dollar deals on Tuesday. The pipeline in the currency is building with Bank Nederlanse Gementeen and Swedish Export Credit Corporation having lined up three year trades.

-

Österreichische Kontrollbank will complete its benchmark funding for the year with a no-grow $1bn five year. Meanwhile, Erste Abwicklungsanstalt has lined up its second dollar deal of the year in the three year part of the curve.

-

This week's funding scorecard looks at the progress of Europe's supranationals and agencies at the start of the fourth quarter.