Nordea Markets

-

◆ Issuer moves swiftly to fund hours after posting quarterly earnings ◆ Deal sets tightest multi-year spread record ◆ Tight deal attracts 'broad-based demand' ahead of likely peer issuance

-

◆ Bookrunners keen to test boundaries with pricing ◆ Strong order book attracts high proportion of real money investors ◆ Trade tightened by 6bp

-

Sovereign achieved ‘significant milestone’ but market participants hope to see more

-

◆ Nordea outmanoeuvres spread widening by waiting to print in euros ◆ It and Crelan's SNP deals attract close to €6bn of orders ◆ 'Right to pay' some concession

-

Diverse deals hit US market as investors look for yield pick-up across issuer types and formats

-

◆ 'Humongous' compression at the long end attractive ◆ Small premium paid on tighter headline level ◆ Tasty pick up still offered over KfW

-

◆ IBB, Saxony-Anhalt, AFL price deals ◆ One trade "accelerated" ahead of cramped market ◆ All notes price tightly

-

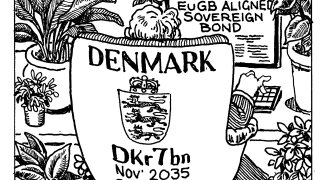

◆ Textbook tightening ◆ Stable conditions open up market ◆ 60% of funding expected to come by June

-

◆ Nordea and CM Arkéa resume European senior funding absent since 'Liberation Day' ◆ Nordea likely to serve as floor for spreads in current market ◆ Arkéa goes slightly longer in its first deal of the year

-

◆ Deal lands flat to Pfandbriefe ◆ No premium paid ◆ Slim spread gap to SSAs

-

◆ Pace of FIG issuance in the US slows down ◆ Nordea the sole Yankee financial issuer this week ◆ Local insurers make up the rest of the primary action with senior and subordinated offerings

-

◆ Cost saving to euros and dollars continues to lure non-UK borrowers ◆ Sterling real money investors show clear affinity for higher spread offerings ◆ Demand slows for tighter Nordea