News content

-

CNY swaps were better offered on Monday because of economic concerns, despite a sizeable recovery in Shenzhen-listed equities. The 2s/5s NDIRS slope is expected to steepen on a corrective move after the recent flattening, writes Deirdre Yeung of Total Derivatives.

-

HSBC has appointed Tim Spray as head of loan syndications EMEA, less than three months after he was given a new role at UniCredit.

-

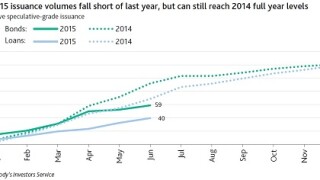

This could still be a record year for European leveraged finance, Moody's has said, even though issuance of both bonds and loans in the first half was down on 2014's levels.

-

This week's scorecard features updates on the funding progress of selected Scandinavian agencies.

-

KfW on Friday priced the largest Kangaroo deal since April and has reopened the Australian market for more supranationals and agencies to follow, said niche currency bankers.

-

Slovenia’s development bank, SID banka, has picked banks for a potential euro transaction five years after its last benchmark issue.

-

Chinese car dealer Baoxin Auto Group could increase the size of its latest borrowing from $150m, following healthy demand during syndication that saw lenders from the Gulf, Taiwan and Hong Kong join in.

-

Mexico is seen as a bright spot in the emerging markets, and investors are hungry for assets. But while disintermediation has provided plenty of fodder in corporate funding markets, the banking sector has yielded far less issuance. Could an increase in lending tip the scales? Will Caiger-Smith reports.

-

Xinjiang Goldwind Science & Technology ventured into an uncharted territory on July 16 issuing the maiden green bond by a Chinese issuer. While the deal is expected to be the first of many, investors were largely indifferent about the trade’s green credentials.

-

China Minsheng Investment’s (CMI) $300m offering on July 16 resonated well with the combination of robust anchor demand, a standby letter of credit (SBLC) and juicy yields proving a winning recipe.

-

VTB has launched a multi-tranche tender offer for dollar, Australian dollar and Swiss francs bonds.

-

Chinese automobile dealer Zhongsheng Group Holdings is considering increasing the size of its $150m loan to accommodate excess demand. The deal offers all-ins close to 400bp and juicy pricing was instrumental in bringing in banks.