Top Section/Ad

Top Section/Ad

Most recent

US issuers and insurance companies could benefit as Moody’s relaxes parts of its approach

Investors attracted by relative value versus loans but are not blind to risk

Floridian manager registered the vehicle in Ireland with article 8 SFDR classification

More articles/Ad

More articles/Ad

More articles

-

French optician Afflelou is looking to sell senior secured high yield notes, in order to pay back state loans and refinance outstanding debt.

-

Banks backing the successful Allied Universal bid for UK security company G4S are set to split around $100m in financing fees for backing the deal, with Credit Suisse and Morgan Stanley in line for the lion’s share of the profits, as the $6.3bn eight tranche syndication is priced and the firm is delisted.

-

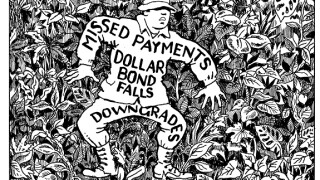

Indonesian textile company Sri Rejeki Isman (Sritex) saw its bonds plummet in the secondary market this week, as investors grappled with the company's missed debt payments and a series of ratings downgrades. Morgan Davis reports.

-

Golden Goose, the Italian shoemaker bought by Permira just before the coronavirus pandemic struck Europe, is looking for €470m of senior secured bonds to repay bridge facilities signed in the acquisition.

-

German cruise liner Tui Cruises is marketing its first high yield bond, as it emerges from a devastating year for the company and the broader travel sector.

-

Indonesian textile manufacturer Sri Rejeki Isman (Sritex) has seen its dollar bonds fall to new lows in the secondary market, as investors grapple with the company's missed debt payment.