Top Section/Ad

Top Section/Ad

Most recent

US issuers and insurance companies could benefit as Moody’s relaxes parts of its approach

Investors attracted by relative value versus loans but are not blind to risk

Floridian manager registered the vehicle in Ireland with article 8 SFDR classification

More articles/Ad

More articles/Ad

More articles

-

Sino-Ocean Capital Holding has raised $500m from a two year bond. The deal was the company’s longest in the offshore market, but came with a weaker structure than its past outings.

-

Tyre manufacturer Gajah Tunggal had to battle weak sentiment around Indonesian credits to sell a $175m bond this week.

-

eHi Car Services tapped its 2024 notes for an additional $150m on Wednesday, bringing the total deal size to $450m.

-

NH Hotels has successfully refinanced its existing 3.75% 2023 bonds with a new €400m five year non-call two high yield bond, with the hotel chain supported ahead of the issue by a €100m cash injection from its shareholder, Thailand’s Minor Group. It will carry on shoring up its liquidity position in the months ahead, with a €200m sale-and-leaseback deal set to close shortly.

-

GlobalCapital reveals today the winners of its Bond Awards 2021, including celebration of the achievement of top corporate banks and issuers — and Lifetime Achievement Awards for two of Europe’s most prominent corporate funding officials.

-

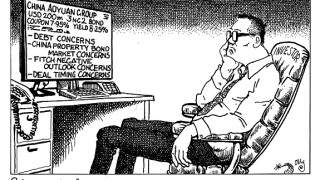

China Aoyuan Group’s attempt to woo investors to its $200m bond with a generous yield fell flat on Tuesday. Recent concerns about the property developer’s leverage, and the subsequent fall of its dollar bonds in the aftermarket, held investors back from the new deal — and caused a further spiral in secondary. Morgan Davis reports.