Top Section/Ad

Top Section/Ad

Most recent

US issuers and insurance companies could benefit as Moody’s relaxes parts of its approach

Investors attracted by relative value versus loans but are not blind to risk

Floridian manager registered the vehicle in Ireland with article 8 SFDR classification

More articles/Ad

More articles/Ad

More articles

-

HSBC has made Mehmet Mazi global head of debt trading and financing, a newly created position. It comes after the departure of Elie El Hayek, a veteran of the bank who had run fixed income.

-

Troubled Italian ferry company Moby has said that the restructuring proposals it had received from bondholders so far were ‘incompatible with the applicable laws’, ‘incompatible with existing operational contracts’ and ‘excessively penalising creditors outside the ad hoc group’.

-

Asian debt borrowers were able to skirt market volatility for much of last week, selling more than $9bn of bonds. But the market slump hit Asia hard as the week drew to a close and the jitters continued on Monday morning.

-

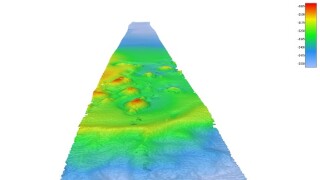

The only high yield bond deal being actively marketed in euros this week has been postponed. The deal was for Fugro, the Dutch company that provides geographical data and asset integrity services to onshore and offshore industries. It was a debut issue for a listed company with no sponsor involved, so there had been good interest, but market conditions just proved too difficult.

-

Three Chinese real estate developers braved a volatile market on Thursday, raising $800m as fears around the coronavirus continued to ravage secondary prices.

-

Leveraged finance investors are no shrinking violets, and held out longer than most against the rising pessimism caused by the coronavirus. But by Thursday, it was even giving high yield and leveraged loan players a sinking feeling.