Top Section/Ad

Top Section/Ad

Most recent

Dasha Sobornova joins from Akin Gump with experience across asset classes

Trade body for levfin investors turns to leading rating analyst

Demand for riskiest tranches and improved loan supply could support growth in issuance

Dana Point 'no longer the end' of the year as market retains momentum

More articles/Ad

More articles/Ad

More articles

-

As the leveraged loan market recovers following a pronounced selloff at the end of 2018, some CLO investors are eyeing a potential reboot to the flatlined CLO market if sentiment in leveraged loans remains upbeat.

-

Sidley Austin has hired Steven Koyler to join the firm’s global finance practice as a partner in New York.

-

A wave of mutual fund redemptions is pushing a loan market sell-off deeper as investors look to cash out of a potentially overheated investment, said leveraged loan market sources this week.

-

Against a backdrop of rising Libor rates, deteriorating loan covenants and strong corporate earnings, CLO participants in 2018 had to digest a host of mixed signals from the market. Investors and managers are cautiously eyeing a continued bull run as the sector comes to a late-cycle crossroads in 2019.

-

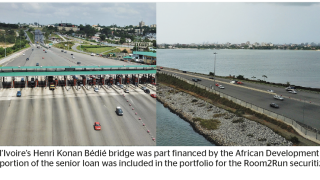

Synthetic risk transfer markets have had another good year, with the core group of banks active in the market returning to issue, smaller firms mulling the market, and investors raising new cash to buy deals. But perhaps most exciting is the development of a whole new issuer base, in the shape of multilateral development banks, following the landmark ‘Room2Run’ deal between the African Development Bank and Mariner Investment Group.

-

US CLO issuance has almost entirely tapered off in the final weeks of the year, but a select few deals are crawling through the pipeline even while spreads are near recorded highs for 2018.