Latin America

-

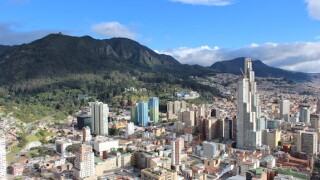

Colombia has increased its external funding programme for the year to over $10bn after forecasting a larger 2021 fiscal deficit than it recorded in 2020, exacerbating concerns about the government’s ability to maintain its investment grade credit rating.

-

Bond bankers covering Latin America say that previously rare 20 year deals could become a popular maturity for the region’s sovereigns after Peru included a 2041 note in a $4bn triple-tranche dollar issue this week. The sovereign followed up the dollar deal with €825m in euros on Thursday, thus wrapping its external funding needs for the year, according to a finance ministry official.

-

Modest order books and higher new issue concessions for dollar and euro issues this week showed that emerging markets borrowers are operating in a different market to a month ago, before inflation concerns had brought non-stop volatility to US Treasury markets.

-

Fitch Ratings said on Wednesday that it would continue to provide international ratings and research on Mexican government-owned oil giant Pemex even after the issuer said it was dispensing with the agency’s services. Previously, Mexican president Andrés Manual López Obrador had publicly criticised Fitch’s negative rating actions on Pemex, which accounts for nearly 10% of investor holdings of EM corporate bonds.

-

Beef exporter Minerva navigated another volatile day for Brazilian assets to raise $1bn of new 10-year non-call five notes on Wednesday, offering a slight pick-up to rival Marfrig that bankers saw as justified given Marfrig’s larger size and US operations.

-

International bonds issued by El Salvador and Costa Rica are proving to be a sweet spot for EM investors, with the notes extending their rally this week as both countries look closer than ever to signing IMF programmes. But there are risks to the positive credit narratives driving the performance of both sovereigns, analysts warned.

-

Argentina’s northernmost province, Jujuy, said on Monday evening that it had reached an agreement with more than half the holders of its $210m green bond regarding a restructuring proposal that would grant it significant short-term debt relief.

-

South America’s largest beef exporter, Minerva, will look to price a new 10 year non-call five bond on Wednesday as part of a liability management exercise that will be debt-neutral or debt-negative.

-

Brazilian mining giant Vale said on Friday that it plans to prepay its €750m January 2023s as record iron ore prices allowed it to build cash levels greater than its gross debt.

-

El Salvador’s bonds retained recent gains on Thursday as EM’s riskiest credits proved resilient to the week’s US Treasury sell-off, with bondholders hoping that Sunday’s mid-term elections will give president Nayib Bukele the political capital he requires to implement an IMF programme.

-

Emerging market assets took a hit after several days of US rates volatility this week as market participants braced for further gyrations and issuers avoided raising dollar bonds. Market participants are praying that further central bank stimulus will pacify markets and believe that the asset class is far better prepared for higher rates than it was for the 2013 taper tantrum. Oliver West, Lewis McLellan and Mariam Meskin report.

-

Spreads on Petrobras’s bonds recovered most of their lost ground this week after a sharp sell-off followed Brazilian president Jair Bolsonaro sacking the company’s chief executive on Monday. But while strong quarterly results released on Wednesday were a reminder of the state-owned oil and gas giant’s fundamental strength, Bolsonaro’s actions have led to questions around policy decisions in an economy with major fiscal issues.