Latin America

-

Sovereign authorised to issue up to $1bn but some investors still have doubts on IMF programme

-

'Stressful' Trump victory could make EM a tricky sell for fund managers, but Banorte, MSU test appetite

-

Execution impresses as sovereign found itself in sub-par market conditions

-

Spanish bank sees ‘strategic rationale’ in being in Brazil as it looks to up wholesale banking revenues

-

Colombian quasi-sovereign pays 15bp more than last week's cancelled deal, but mostly thanks to wider market

-

Latin America's largest carrier says that new senior secured bond will save it $83m in interest expense

-

Latin American supranational extends its curve with second Swiss visit of the year

-

Chilean issuer balances size and price with debut Swissie

-

Brazilian debutant offers 13% at IPTs two months after first roadshow

-

Investment grade Shell-Cosan JV in Brazil reprices curve tighter after 3bp NIP

-

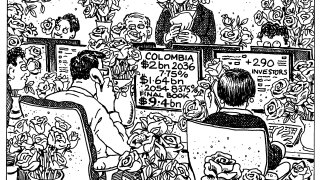

Deal represents new way for government to use private capital for public policy objectives

-

US oil company gains following from traditional EM buyers and US high yield investors