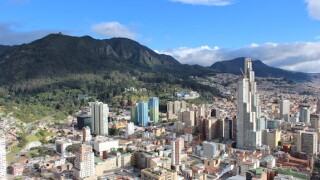

Latin America

-

EM bond buyers scramble to put cash to work allows sovereign to print far inside level of last deal from two months ago

-

Buying back debt cheaply does nothing for long-term debt sustainability nor bond market access

-

Lender’s dollar bond could push region’s smaller issuers to “get off the fence” and restart issuing

-

‘Stars aligned’, says issuer, as third double-A rating coincides with improved tone

-

Early-year strength has surprised many issuers, who may need to hurry not to miss their chance

-

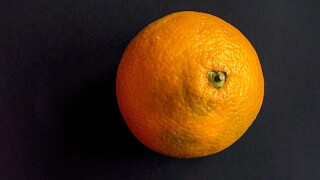

Tangelo, the issuer formerly known as Mexarrend and Docuformas, will not make coupon payment on January 24

-

Brazilian labelling manufacturer raises €120m for subsidiary Tags Lux

-

Rare single-B name notches $400m but costs too high for most

-

Colombia’s state oil firm breaks long hiatus in LatAm corporate issuance

-

As a single-B rated credit, Liberty Costa Rica would be an unusual reopener for LatAm corporate bond issues

-

Secondary performance suggests additional demand but public credit head happy to kick off funding early

-

Sovereigns find exceptional issuance window but market still fragile