Latin America

-

Three Latin American borrowers clinch strong deals while US Treasuries sell off again

-

Longer maturity plays into sovereign’s IMF-mandated strategy to substitute expensive local debt for external funding

-

Public debt office keen to encourage foreign buyers into inflation-adjusted bonds

-

LatAm sovereign includes emissions and gender-related KPIs in first ever syndicated deal in inflation-adjusted unit of account

-

LatAm development bank follows seven other issuers into the market this week as supply hits $7bn

-

BNG, Finnvera and EAA join peers to tap three year part of the curve

-

Sticker shock wearing off in LatAm is an encouraging and necessary omen

-

Cancelling dollar tranche seen as ‘inelegant’ but investors say more peso debt is encouraging

-

Spree of global local currency issuance is a reminder of a key strength in many countries in the turbulent region

-

Caribbean issuer takes $560m of seven year money as credit story shows signs of turnaround

-

Brazilian issuer raises $850m amid petrochemical industry downturn

-

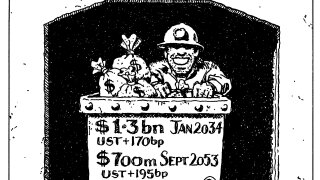

JBS also sells a dual-tranche as well-known names waste no time after Labor Day