Italy

-

UnipolSai Assicurazioni, the Italian insurer, is gearing up to sell a rare 10 year bullet tier two transaction, despite subordinated debt’s recent moves wider.

-

Following an €8.1bn state bail-out, Banca Monte dei Paschi di Siena still has its work cut out in putting ticks in the boxes of its 2021 restructuring plan.

-

Italian high speed train operator Italo pulled its IPO on Wednesday night, the day before the syndicate was due to release a price range, of €1.5bn to €1.6bn, in order to take a €1.98bn offer from New-York based private equity firm Global Infrastructure Partners.

-

Fabio Gallia, who became chief executive of Cassa Depositi e Prestiti (CDP) in 2015, is overseeing its ambitious 2016-2020 business plan. In this interview, he shares his views with GlobalCapital on the prospects for the Italian economy and the role CDP will play in supporting its accelerated recovery.

-

Italy’s large companies had a bumper 2017 in the bond markets but they are well known names with investment grade ratings. What about the backbone of the Italian economy — how are the SMEs that form the supply chains of larger companies finding finance as the country emerges from its long economic winter and seeks out stable growth? By Nigel Owen.

-

What is the outlook for 2018 for Italy’s corporate borrowers, after a year in which old and new names came to the bond markets with great success? Some of Italy’s most important treasury teams met GlobalCapital to discuss the prospects for the year ahead. Funding teams and investment bankers shared their views on the state of the local and international economies, how they are finding access to capital markets and what the future holds as the ECB tapers its corporate sector purchase programme and investors adjust to a new era of normalisation.

-

Italian financial institutions had an exceptional year in 2017. Banks that had been flirting with collapse were either recapitalised or allowed to fail, with very little disruption spilling over into the broader market. All this helped to make Italy an attractive destination once again for international investment, clearing some of the clouds hanging over the financial system and allowing firms to increase the volumes of debt they placed into the public capital markets.

-

Italy’s biggest corporate bond issuers such as Enel and ENI have been agile players right through the crisis years. Spreads were turned upside down and companies traded inside the sovereign. Many still do, but Italy’s corporate bond market has changed greatly. The group of issuers has swelled and they have gone far beyond merely securing market access, to considering how to optimise their funding with a range of instruments, from liability management to green bonds. Nigel Owen reports.

-

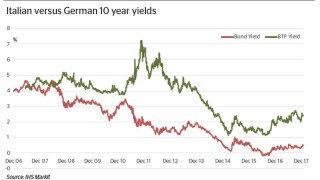

Italy may be holding the eurozone’s only major election in 2018 but the vote is causing little concern for bond investors, with a backdrop of solid growth and a new electoral law likely to keep fringe parties from wining outright power. While the improving economic outlook is generally good news, it does raise potential political challenges of its own — although the sovereign is confident enough about 2018 that it is planning to tap the dollar market for the first time in eight years, writes Craig McGlashan.

-

Italy’s retail bond market is going through a profound shake-up in which alternative investments are set to replace bank bonds among the securities of choice for Italian households. Tyler Davies reports.

-

Italy’s economy, like those of its European neighbours, is showing encouraging signs of consistently strong growth. But how much of it should Italy take credit for — and how much is down to the broader improvements in Europe? Has Italy made the most of improving economic conditions and central bank support to enact enough reforms to escape its unwanted tradition of growing more slowly than other economies in the good times and shrinking further in the bad times? Ignazio Visco, governor of the Bank of Italy, answered these questions and many more in an interview with GlobalCapital’s Toby Fildes.

-

Contrary to expectations, the fall of Matteo Renzi has not slowed down Italy’s reform drive. Admittedly, much of the recent progress started under his leadership and even before it, but the country’s continued commitment to economic reform under the Gentiloni administration has been warmly welcomed by economists and investors. The next big test will be a general election in March. By Philip Moore.