Italy

-

Holders of a highly scrutinised UniCredit capital instrument hold a very small proportion of the bank’s equity, according to a source familiar with the matter. This could mean they are more likely to follow the recommendation of activist investor Caius Capital and push for the bank to exchange the notes.

-

SC Lowy co-founder and CEO Michel Löwy talks to GlobalCapital about developing a DCM business, Italy and entrepreneurship.

-

In an age where the triumph of populism has shown that communication trumps all else in politics, it’s strange that the Italian iteration of this trend is struggling with something that couldn’t be clearer — its sovereign debt auction schedule.

-

Unipol Group, the Italian financial services company, conducted a rare reverse accelerated bookbuild on Thursday night, to buy a 3.25% stake in BPER Banca for €73.8m, only six weeks after saying it would not increase its stake.

-

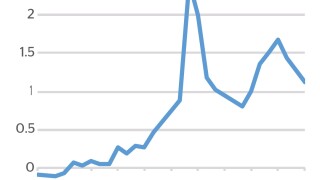

Italy’s bonds suffered another day of rising yields on Thursday after the country’s government appointed Eurosceptics to head financial committees.

-

Telecom Italia became the first Italian corporate to sell a bond deal since the new Italian government was installed but found fates conspired against it as Italian government bonds fell throughout the day.

-

Sovereign debt officials praised the role primary dealers played during the volatility that hit eurozone government debt markets in the second quarter, though some still feel the system is “not ideal”.

-

The market for equity block trades in EMEA has lost some of its shine, with volumes down on last year, and a string of failed trades. This poor performance is in stark contrast to a resurgent IPO market, which in the last two weeks has generated strong returns for investors.

-

Italian banks will no longer need to have a minimum capital base of €250m to issue covered bonds. That suggests potential for an expansion of the market without relying on a multi-issuer framework where banks would pool assets to reach a benchmark size of €500m.

-

The recent swings in the sovereign, supranational and agency bond market due to political turmoil in Italy suggest issuers will have to change the way they execute deals in the coming months. Elsewhere, eyes are still trained on the European Central Bank’s tapering plans, while rising dollar yields are failing to attract SSA investors. Jasper Cox reports.

-

In the political sphere, Europe and North America appear to be travelling in separate directions since the election of Donald Trump as US president in November 2016, as was evident at the recent G7 talks.

-

Quantitative easing, perhaps the single most important factor affecting bond prices over the past three years, could be coming to a long awaited end this year. Members of the European Central Bank governing council seemed to hint as much this week, causing govvie spreads to gap wider, writes Lewis McLellan.