Italy

-

Italian energy company Enel has signed a financing agreement with Bank of China, which will exchange a $1bn credit line for Chinese access to Enel's future projects.

-

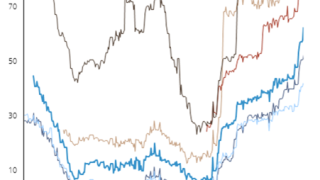

Southern European lenders are back on the defensive as a European Central Bank inspection of non-performing loans drives a pronounced sell-off in equities and subordinated debt.

-

The ECB can’t risk large disruptions in the European capital markets it is trying to support, nor paranoid doom spirals in the banks it supervises. So it needs care when and how it communicates with the market.

-

Spreads on covered bonds from Italy’s weaker credits have shot skyward this week, with indicative bids in the worst affected names out by at least 25bp since the start of the year. The moves have followed renewed concerns over their non-performing loans.

-

The Italian subordinated debt market has come under further pressure this week, with spreads shooting wider amid renewed concerns about banks’ high levels of non-performing loans.

-

HeidelbergCement, the German building materials manufacturer, has done part of the financing for its acquisition of ItalCementi in the Schuldschein market, but insists it is not afraid of volatility in the bond market.

-

Several major Italian ECM deals are set to move forward in the next few weeks. Saipem, the oilfield services company, will open subscription for its €3.5bn rights issue on Monday January 25. And Veneto Banca is set to announce in the next couple of weeks more detail of its €1bn capital increase and flotation, to be completed in April.

-

Crédit Agricole and Intesa Sanpaolo required big premiums to reopen the euro and dollar additional tier one (AT1) markets this week, and bankers fear others will have to follow due to poor secondary liquidity in the product.

-

-

-

A trio of Spanish issuers launched the first covered bonds of the year from southern Europe this week but, with peripheral spreads widening sharply, conditions are not conducive to further supply.

-

Investors in the public high yield bond market have gone right off riskier structures such as payment-in-kind notes, only two months after they eagerly grabbed a €1.1bn PIK deal for ICBPI, one of the biggest of its kind.