Italy

-

Telecom Italia brought the first telecoms bond deal of the year to the European market on Wednesday, tapping both high yield and investment grade investors.

-

Portugal is limbering up for its first benchmark of the year in a week heavy with eurozone periphery sovereign issuance, including an auction where Italy’s three year yield nearly dipped below zero.

-

The initial public offering of Ferrovie dello Stato Italiane, the Italian state-owned railway network, may take place this year, the country’s finance minister said on Tuesday.

-

Intesa Sanpaolo opened the 2016 additional tier one (AT1) market on Tuesday with its euro debut, and is now over halfway to its 2017 issuance target.

-

Italian property has been one of the more disappointing sectors in European equity capital markets recently, so it was a welcome change that in a still bare calendar of formally announced IPOs, two of those that have appeared are for Italian real estate investment trusts.

-

Spain has mandated for its first deal of the year, but the sovereign has taken the rare step of bringing a syndication in the same week as it is holding auctions.

-

Intesa Sanpaolo is set to print the first additional tier one transaction of 2016 after opening the dollar tier two market for European banks last week, while ABN Amro opened the euro bank capital market on Monday.

-

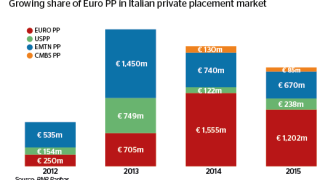

The Italian loan market, benefiting from an injection of central bank cash, is providing the country’s corporates with increasingly competitive terms and pricing. It’s rise, however, has left private placements in the shade, writes Elly Whitaker.

-

The last time a newly rated Italian issuer tried to issue a corporate high yield bond was in May — but take a step back and the wider picture points at a resilient, vibrant market with an investor base up for the challenge. Victor Jimenez reports.

-

Italian corporate DCM bankers are looking forward to a busy 2016. Last year may not have been as active as hoped, but an upcoming raft of redemptions and falling competition from the loan market mean volumes are only likely to go up, writes Nathan Collins

-

Italy’s economic recovery has not yet encouraged an increase in corporate bond issuance, with Italian companies still focusing more on deleveraging than on raising new finance to support capital expenditure or M&A activity. The result is a striking imbalance between supply and demand in the Italian corporate bond market which has led to new issues from frequent as well as less established borrowers being heavily oversubscribed. In this GlobalCapital roundtable, which was held in December, issuers and intermediaries gathered to discuss the outlook for the supply-demand dynamic in the Italian corporate bond and loan universe.

-

Italian banks have come through a challenging year as pressures — from regulators, markets and the economy — waxed and waned. Issuers and investors have had to navigate the looming introduction of the Bank Recovery and Resolution Directive, Total Loss Absorbing Capacity and Minimum Requirement for own funds and Eligible Liabilities, which have changed the dynamics between senior unsecured paper, covered bonds and capital issuance. The Italian market also felt one of the strongest impacts in the eurozone from the European Central Bank’s quantitative easing programme, which provided cheap liquidity and tightened issuance spreads, but in some cases appeared to drive investors away and into higher-yielding asset classes. Meanwhile, an economy clawing its way back to health continued to impose a heavy burden of non-performing loans, and legislative reforms left smaller players in the sector looking for merger partners. In this roundtable, held in early December, leading funding officials and bankers gathered to discuss these issues and more.