ING

-

Investors hoping for new investment grade corporate bonds this week may be disappointed, as widening spreads and falling equities make the market less tempting for issuers.

-

The European Commission has asked the European Banking Authority (EBA) to say how Basel IV could affect banks’ ability to meet their total loss-absorbing capacity (TLAC) requirements — work that it says is "essential" to understanding the impact of the new reforms.

-

Corporate borrowing activity is expected to be sustained throughout the second half of the year as borrowers "take advantage" of the liquidity in the loan market. The expectation comes in the aftermath of two large dividend recapitalisation transactions by Polish corporates, Allegro and Żabka, in the second quarter.

-

International investors this week enthusiastically bought a $500m ‘sustainable transition bond’ issued by Marfrig, the second biggest Brazilian beef producer. The deal highlighted its efforts to make its supply chain more sustainable. But Greenpeace, the environmental NGO, argues it is impossible to be sure the supply chain does not include harmful practices.

-

The latest idea captivating sustainable finance enthusiasts is transition bonds.

-

Marfrig Global Foods, the Brazilian beef producer, has stirred up the green finance market by issuing a $500m ‘sustainable transition bond’. To some, it is a template for a new asset class that can help finance the global economy’s shift to lower carbon emissions. To others, it is a shocking case of greenwashing. By Oliver West and Jon Hay.

-

Hungarian gas and oil company MOL has extended part of an existing €555m revolving credit facility by one year, in what is one of the few sparks of activity in the country's syndicated loan market so far this year.

-

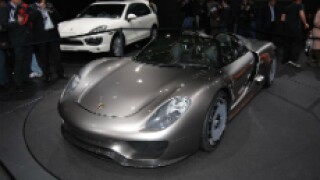

Porsche AG, maker of Porsche sports cars, closed a green Schuldschein this week, with pricing and allocation set for Friday. The final size is rumoured to be €1bn, with an order book far exceeding that.

-

Brazilian meatpacker Marfrig is looking to fund cattle purchases that meet its environmental and sustainability criteria through a debt sale that the company is describing as a “sustainable transition” bond.

-

Russia's largest producer of anthracite coal, Siberian Anthracite, is expected to complete a loan refinancing in September. The deal will see Sibanthracite switch its existing loan facility from dollars to euros, as bankers offer a number of reasons for the switch, including preventative protection from sanctions and the elimination of operational delays.

-

Cofco International, a commodities trading unit of China’s agri-products company Cofco, has increased its sustainability-linked loan to $2.3bn after receiving commitments from 21 lenders.

-

Polish convenience store operator Żabka Polska is expected to close its dividend recap imminently, according to market participants. Bankers have compared the deal to the dividend recap transaction that Polish e-commerce platform Allegro completed in May.